London – The financial services industry is embracing digital transformation plans that were accelerated as a result of the pandemic, according to a major recent study from Vodafone Business. This has led to 29% of financial services firms globally being considered ‘Fit for the Future’ (FFTF) and better prepared to deal with future challenges – such as increased competition, changing employee expectations, and rising customer demand.

An overwhelming majority (94%) of FFTF businesses across all sectors believed they were well-prepared for the risks facing them, compared to only 58% of respondents overall. On top of this, 82% of FFTF businesses believe their business continuity plan worked well during the pandemic.

Additional analysis of the research conducted by the London School of Economics found a link between companies being FFTF and business performance. Organisations that scored a 10-point increase in their FFTF score were more likely to outperform their competitors by 36%[1].

Ultimately financial services organisations that are FFTF are more confident and well-prepared for emerging challenges and are better placed to respond quickly to evolving employee and customer demands.

Financial services firms embrace digital transformation and technology

The research shows that the pandemic has accelerated digital transformation within the financial services industry. 69% of organisations in the financial sector now have a roadmap for digital transformation, whilst over half (54%) have already started implementing a digital transformation strategy. The pandemic drove digital transformation within the industry, with 68% of firms accelerating their digital transformation plans and 49% seeing an increase in budget allocated towards digital transformation.

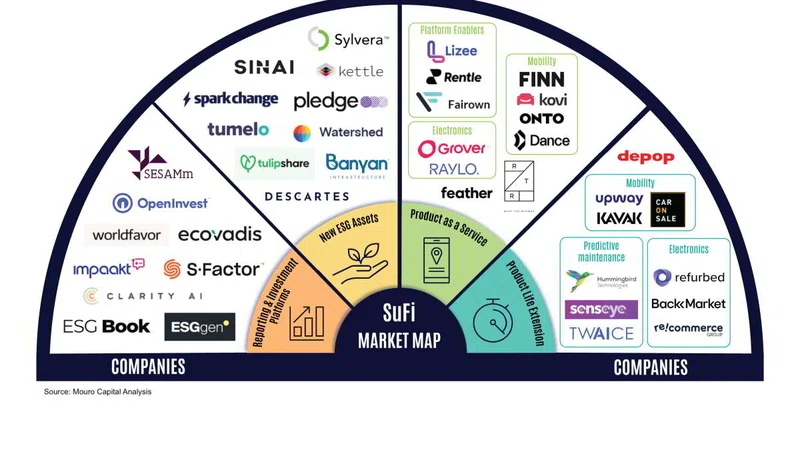

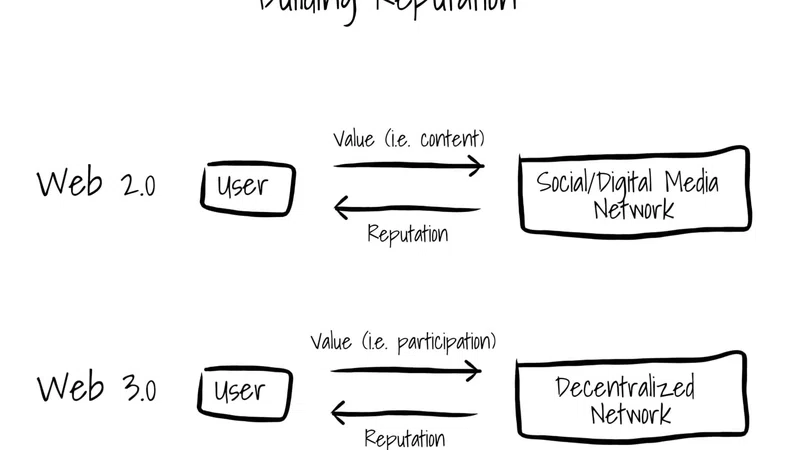

The sector is also leading the way in its adoption of modern technologies, with 49% stating that they like to be the first to try out new a technology, and just 21% wait for the technology to become mainstream before investing. This open-minded approach to technology means that the financial services sector is ahead of other sectors in adopting new technologies such as blockchain (43%), Multi-Access Edge Computing (26%), and Mobile Private Networks (29%).

Customers continue to become more powerful

The study shows that financial services firms believe that their customers are continuing to become more powerful, with 72% of those surveyed believing this to be the case. The research highlights a number of areas in which financial services customers are becoming more demanding, including access to better products and services (79%), the ability to interact with brands any time and anywhere via digital (74%), and needing personalised experiences (78%). This drive towards digital has led to 44% of financial services organisations believing that their online presence is set to become more important than their physical one.

Employees expectations higher than ever before

It isn’t just customers whose expectations have risen; employees also expect more from the financial services firms that they work for. 57% of financial services believe that these employees are becoming more powerful. Employee expectations are also rising in a number of areas, such as wanting more flexibility in terms of where they work (46%), greater expectations on working with the freedom and autonomy that best suits them (51%) and in terms of the hours they work (48%).

In the era of the Great Resignation, financial services companies believe that providing the latest technology in the workplace (86%) and supporting remote working (84%) are most important to staff retention.

Fánan Henriques, Strategy and Transformation Director at Vodafone Business said: “This research highlights that financial services organisations are facing a number of significant challenges, including the changing customer dynamic and the growing expectations of employees. It also shows that the financial services industry is leading the way in both digital transformation and in the adoption of emerging technologies, which will certainly help the sector overcome some of the challenges they currently face. There is no doubt that technology will power the financial service firms of the future, increasing productivity and flexibility, as well as providing the tools needed to grow.”