Riyadh - Hakbah platform, which specializes in alternative savings and Savings Groups, announced the closure of its seed round with a value of USD 1.2 million (SAR 4.5 million), with the participation of a group of investors, after six months of obtaining the approval of the Saudi Central Bank (SAMA) to launch its commercial services in the Kingdom at the end of July 2020.

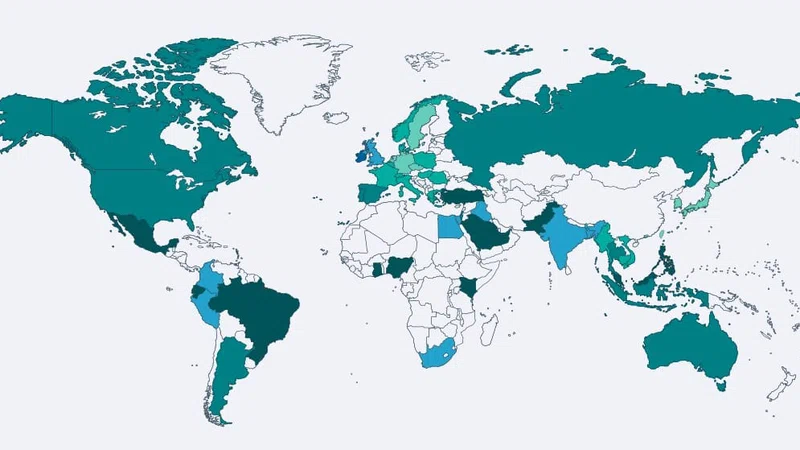

Hakbah aims to modernize and ease saving behaviors through the Hakbah App for Savings Groups in a reliable, trusted, and straightforward manner, helping individuals increase their monthly regular saving amounts within the financial system. Hakbah earns the trust of more than 5,000 verified users, whether Saudis or local residents, representing 25 nationalities.

Hakbah confirms that the pandemic has increased the importance of saving for individuals. One of the most prominent saving habits worldwide is the Savings Groups between family and friends (aka. Jamiya). Hakbah estimated the savings groups' market size in Saudi at more than USD 6 billion (SAR 24 billion) annually. Savings Groups are traditionally managed and not appropriately serviced before the launch of Hakbah app. We seek to make a difference and enable individuals to safely, transparently, and easily control their savings through the Hakbah app. This investment round comes from the investors' confidence in Hakbah's strategic plan and performance that Hakbah are proud of, as a first culmination of the work team's efforts during the last period. A speedup for the next phase's goals, especially in continuous product development, attracting top talents and accelerating marketing efforts, aim to serve more than 25,000 customers in the coming months. Hakbah extended its thanks to the team of the SAMA's Sandbox and Saudi Fintech for their support, confidence, and eagerness, and overcoming the obstacles facing companies operating in the financial technology sector.

Hakbah graduated from the DIFC Fintech Accelerator Programme 2019. It signed a strategic partnership agreement with Visa and joined the global 'Visa's Fintech Fast Track' program in September 2020. It seeks to be the preferred platform for alternative savings in the region.