DIGIDOE, the London-based startup which is on a march to revolutionise the world’s outdated payments infrastructure, has secured more than £850,000 from new investors.

The initial funding round was closed early because of high levels of customer interest in DigiDoe’s unique next generation, fraud-inhibiting, multi-currency payments system.

DigiDoe is the first company in the UK to offer biometrics-based payments to merchants without the presence of a card or phone.

Led by investment firm, Joint Journey, which prides itself in capitalising on market and technology trends, along with several individual investors, the fresh funding amounts to £852,500. It gives DigiDoe a 12-month runway to enhance its proprietorial technology.

Alexandra Vidyuk, co-founder and executive director of DigiDoe, said: “It’s immensely encouraging to have customers knocking at the door so early in DigiDoe’s journey, as we revolutionise the creaky payments infrastructure that businesses have to deal with every day.

“While cash has gone out the door and card and phone payment capabilities have soared in recent months, behind the scenes the global payments system is still stuck in the dark ages. DigiDoe is changing all that and more. With our secure, fraud-free solution all you’ll need to pay for dinner in future is your smile.”

DigiDoe is already trialling its patented multi-factor biometrics-based 7D user authentication technology which leverages the latest technological and biometrics advances including secure channel “signatures”.

Sergey Dashkov, co-founder at Joint Journey, said: “DigiDoe’s cutting-edge technology unleashes the payments system of tomorrow, and we are thrilled to be part of that journey. The payments infrastructure of today is ripe for disruption and we believe DigiDoe is the disruptor to succeed.”

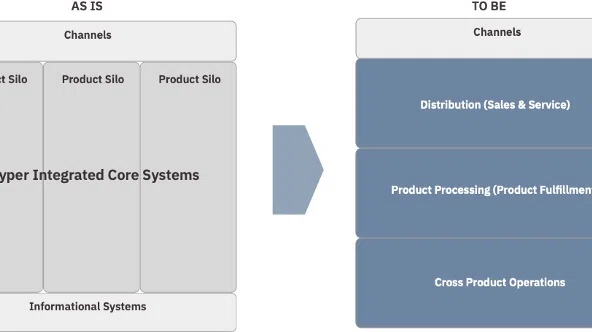

Designed from scratch, Digidoe’s efficient payments system reduces fraud, cuts fees and costs for merchants, enables ultra-low cost, hassle-free payments which eliminate the need for plastic cards or mobile phones to complete transactions.

While current credit card providers can generate around 60,000 transactions per second, DigiDoe can generate 200,000 per second.