Ranqx, the leading provider of fully digital lending solutions for small-to-medium sized businesses (SMB), has become the first non-North American candidate to be shortlisted in the final of the prestigious MyVentureTech Fintech Showcase.

A proud New Zealand based company, Ranqx is making a significant impression on the SMB lending market in the US since its launch there in August 2022.

As the first platform to fully digitise SMB loan origination, decisioning, and monitoring for banks, Ranqx is set to revolutionise the world of SMB lending. By offering rapid data collection through highly innovative intelligence systems, Ranqx allows banks, credit unions, and lenders to have more control over their lending decisions.

With a faster time to decision making alongside greater risk analysis, Ranqx is opening up the lending possibilities for SMBs who need it most, whilst offering higher levels of security to lenders.

Ranqx was selected from over 50 applicants to make the final 16 of the MyVentureTech Fintech Showcase, which will be held at the VentureTech conference in Frisco, Dallas, from Monday 7th- Wednesday 9th November.

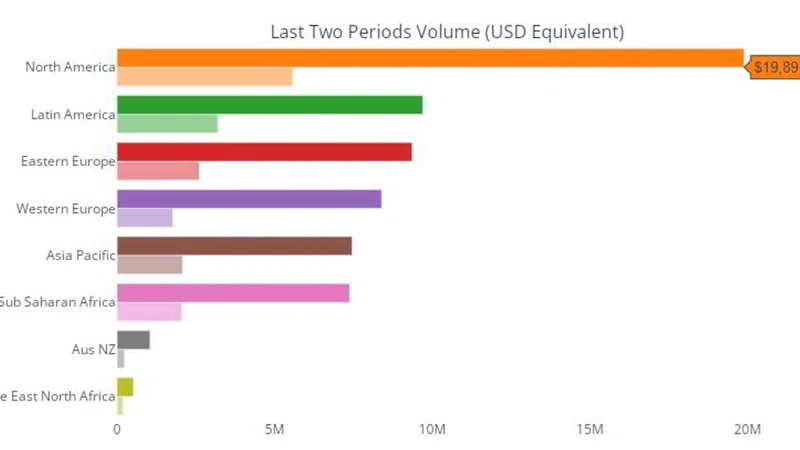

Following its success in APAC, including high-profile partnerships with Mambu and Visa, Ranqx’s shortlisting is further proof of the significant impact that the Ranqx solution is set to bring to North America’s SMBs and credit unions alike, driving positive change in the lending space.

Continuing its mission to enable inclusive credit lending for SMBs worldwide, the recognition is testament to Ranqx’s technology and innovation. As the only non-North American candidate, Ranqx is representing New Zealand on the global fintech stage and encouraging future investment in Australasian start-ups.

Founder and CEO of Ranqx, Dave Lewis, will present to over 7,000 US credit unions ahead of the announcement of the Showcase prize. Speaking of the shortlisting, Dave said: “I’m truly honoured that Ranqx has been selected in the VentureTech Fintech Showcase. Being invited to present our business in front of the entire credit union industry is a huge feat for a growing New Zealand start-up such as Ranqx.

“Our ability to deliver fast deployment for lenders, as well as rapid access to vital capital for SMBs, has been significant in transforming the Australasian lending market. We intend to replicate this in North America.”

He continues: “We’re incredibly proud of the solution we’ve created, and the results we see will always drive our mission forward. It’s also fantastic to be recognised by our peers within the industry.I’d like to take this opportunity to wish everyone participating in the showcase the best of luck, and I’ll see you all in Frisco on the 7th November!”

Ranqx’s ground-breaking digital lending platform has already become a key tool for innovative lenders and SMBs within the APAC region and is beginning to flourish within North America too. The solution has helped to generate loan-related cost savings of up to 80 per cent, highlighting the impact of digital data intelligence.