BOSTON – July 7, 2022 – Mendix, a Siemens business and global leader in modern enterprise application development, today announced that Zurich, the international insurance giant, has rolled out two major new enterprise-wide solutions that streamline workflow for underwriters and transform user experience for 1.5 million customers. Both solutions were built using the Mendix low-code platform.

Zurich used the Mendix software development platform to improve its applications development process, and iterate faster and more efficiently. The insurer has so far used low-code to rebuild a legacy-based policy application that calculates premiums and captures data for terrorism coverage. In addition, Zurich leveraged low-code to build “My Plans Portal.” This application enables 1.5 million customers to log on and obtain all their pension and investment information in one location.

Taking terrorism coverage into the modern world

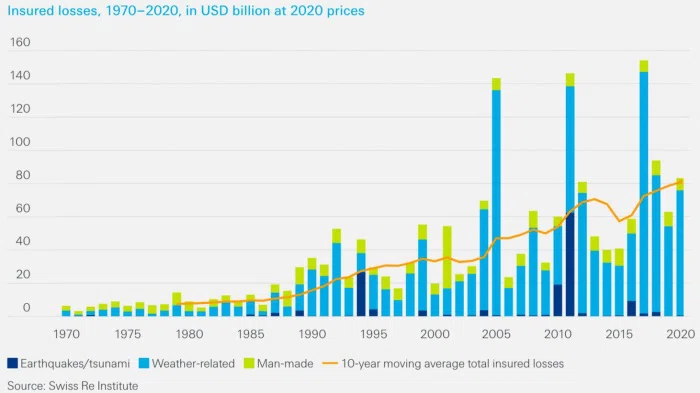

Terrorism coverage is a necessity for Zurich’s customers. For Zurich, this aspect of the business generates millions of pounds of revenue in gross written premiums, about two-thirds (roughly 20,000) of Zurich’s coverage policies. The insurer’s execution of its terrorism underwriting process previously depended on a legacy application to calculate premiums and capture customer data.

Barrington Clarke, head of UK DevOps at Zurich, said: “Our first project with Mendix was to overhaul the legacy application that managed the terrorism underwriting process. Using Mendix, we replaced the legacy system and built the Terrorism Data Capture (TDC) application in just 12 weeks. This new application provides a unified workflow to reduce manual processing, increases reporting accuracy, speeds up the preparation of terrorism submissions, and provides a better experience for the underwriting community.”

Creating the “My Plans Portal”

Zurich is using the Mendix low-code platform to build applications that improve the user experience for customers. One example is the newly launched “My Plans Portal,” which allows the customer to log on online and access all their pension and investment information in one place. This Mendix-built application communicates back to Zurich’s Salesforce platform, integrates to the back-end system, and ensures tasks or activities can be put into a workflow.

Clarke added: “We had a book of insurance business with around 1.5 million customers. Although there was a digital portal for support, not all the customer data and information was available Sometimes a telephone call was needed to service a customer’s requirements. This was time-consuming for the customer and ultimately didn’t deliver a positive experience for them. Our new “My Plans Portal” enables a more seamless experience for customers and is something we plan to expand further by using Mendix in the future.”

Saying goodbye to legacy Lotus Notes applications

The latest project that Zurich is working on is a complete overhaul of legacy Lotus Notes applications. The insurer currently has more than 1,000 such applications handling business processes, from simple forms that can easily be converted using automated processes, to complex UI workflows that are more difficult to redevelop. This is a long-term project that will continue into 2022, but it would have taken Zurich five times longer with Java and at a far higher cost.

Clarke said: “These Lotus Notes applications are very old. Some were developed more than five years ago and no longer fit the operating model of our business. This has caused numerous problems, including shadow IT, as employees look for quicker workarounds. Mendix provides us with the ability to replace, amend, and update these applications, because low-code makes it so quick to do these sorts of activities.”

Paul Fondie, global industry principal for insurance at Mendix, said: “Zurich is a great example of an insurer using technology to provide its customers and employees with the best experience possible. Low-code can provide organizations in this industry with the tools they need to drive digital transformation. The pandemic has accelerated the need for these digital solutions, with more customers moving online than ever before.”