FT Partners is pleased to announce our role as exclusive financial and strategic advisor to PPRO on its $180 million growth financing from Eurazeo Growth, Sprints, Wellington, and one of the world's largest asset managers, at a valuation of over $1 billion. In the last month or so, we've also raised $100-300 million rounds for unicorns including Mambu at a $2 billion valuation, and Divvy at a $1.6 billion valuation, and also sold BNPL player Acima for $1.7 billion. It's been a busy new year thus far, with much more on the way.

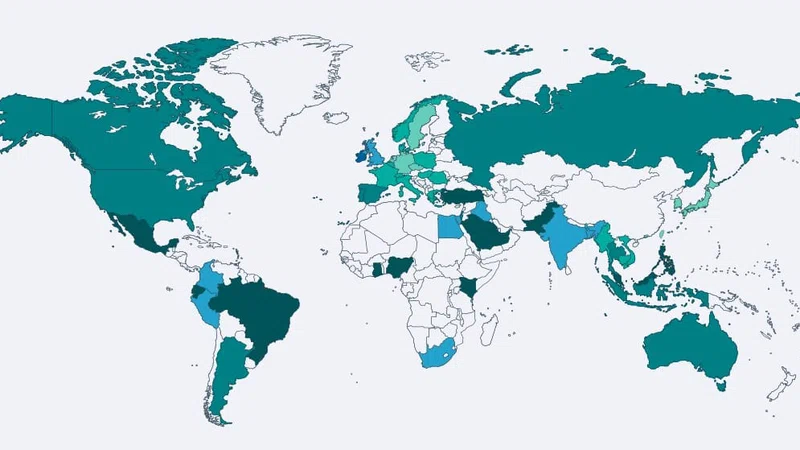

Headquartered in London, PPRO is the world's leading local payments platform-as-a-service, removing the complexity of domestic and cross-border payments for top-tier financial institutions, payment service providers, and their merchants. PPRO provides partners with the ability to accept locally preferred payment methods like e-wallets, bank transfers, cash, and local cards in more than 175 e-commerce markets across the globe.

FT Partners previously advised PPRO on its $50 million financing in 2018, its acquisition of allpago in 2019 and its $50 million financing round in 2020.