FT Partners is pleased to announce our role as exclusive financial and capital markets advisor to Payoneer on its merger with FTAC Olympus Acquisition Corporation, a special purpose acquisition company (SPAC), for a post-transaction equity value of $3.8 billion.

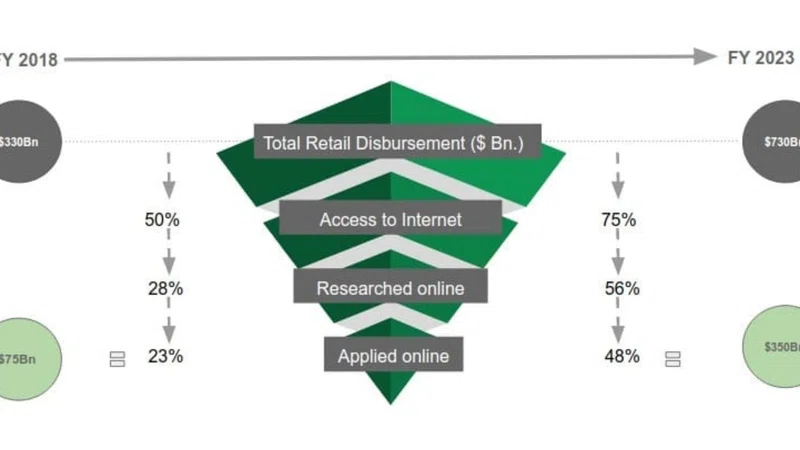

Founded in 2005, Payoneer is a global payment and commerce-enabling platform that streamlines global commerce for millions of small businesses, marketplaces and enterprises from 190+ countries and territories. Leveraging its robust technology, compliance, operations and banking infrastructure, Payoneer delivers a suite of services that includes cross-border payments, working capital, tax solutions, risk management and payment orchestration for merchants..

The Payoneer transaction builds on FT Partners' expertise in selling FinTech companies to SPACs. This marks our fifth successful sale of a FinTech company to a SPAC. FT Partners previously advised:

- Porch on its ~$1 billion merger with PropTech Acquisition Corp.

- Open Lending on its $1.7 billion merger with Nebula Acquisition Corp.

- REPAY on its $665 million merger with Thunder Bridge Acquisition

- CardConnect on its $438 million sale to FinTech Acquisition Corp. (we subsequently advised CardConnect on its $750 million sale to First Data a year later, nearly doubling its valuation)

This transaction also highlights the long-term nature of many of FT Partners' client relationships as well as our deep domain expertise in the Payments space. We previously advised Payoneer on its acquisition of optile in 2019.