Oslo/London – EedenBull, a global fintech innovation company, specialising in B2B and Commercial Payment technology, has announced its expansion to North America with the opening of its first US office, in New York.

This expansion coincides with the appointment of Melissa Sefic as Head of Business Development, North America, EedenBull, to drive and manage the local US business. Melissa joins from The Economist Group, where she was SVP, Head of Commercial Payments International (CPI), an organisation that produces global events for executives in the commercial cards and payments space.

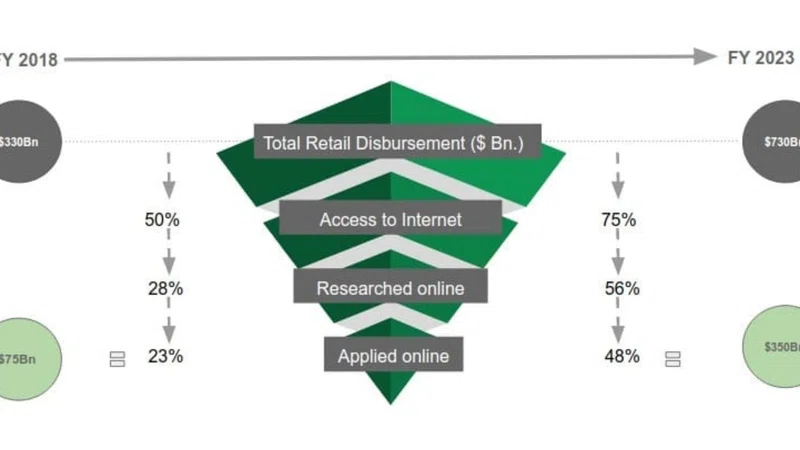

As part of the firm’s global development strategy, EedenBull will provide established and emerging banks in the US and Canada its best in class commercial payment technology and its Commercial Payments as-a-Service (CPaaS) portfolio, to empower progressive-thinking banks to better service their SME and corporate clients.

Nicki Bisgaard, CEO and founder of EedenBull, said: “This US expansion and executive appointment underlines our global growth ambitions, as we’re now fully equipped to offer our deep payment industry experience and Commercial B2B Payment technology to the US banking community, and their SME and corporate customers.”

He continued, “Challenging market dynamics, coupled with the global pandemic have driven the most forward-thinking banks to adopt secure and advanced payment technology, freeing them up to add client value, gain a competitive edge and to sustainably grow. We look forward to helping the US banking community embrace this innovative payment technology, and to grow our US operation.”

EedenBull is already partnering with 65 banks in Europe, and is further building its international reach with global banks, such as National Australia Bank. EedenBull is headquartered in Oslo, has its design and innovation team in Singapore, business development team in London and its operations centre in Edinburgh, Scotland.

EedenBull Partnerships with Global Banking Community

EedenBull was launched by a group of senior banking professionals and experts in digital payments. The enablement of third-party access to data from banks leading to the rise of open banking, has empowered tech-driven non-banking companies, such as EedenBull, to build new and innovative payments services.