Resistant AI, the AI and machine learning financial crime prevention specialists, today announced that FINOM, the Netherlands-based B2B fintech platform for small businesses and professionals, has selected Resistant AI Transactions Forensics to bolster its anti-money laundering measures. Resistant AI will overlay and enhance FINOM's own transaction monitoring system to provide valuable context and uncover new types of unusual and anomalous behavior.

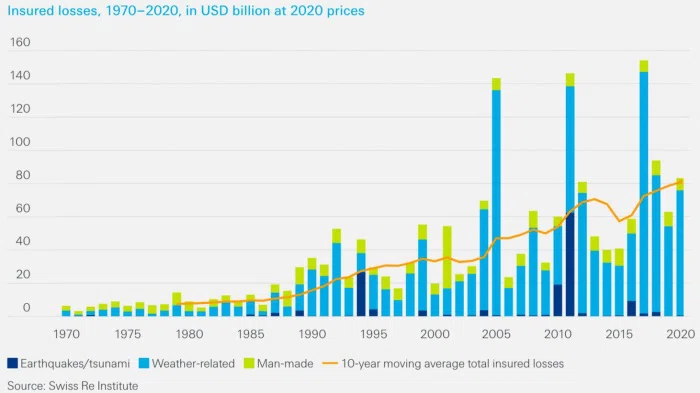

Within Europe, Europol estimates the value of suspicious transactions in the hundreds of billions of euros – at an equivalent of 1.3% of the EU's gross domestic product (GDP). Global estimates are close to 3% of world GDP (please check the "Additional Information" below for further details).

"In a world that is seeing ever-increasing incidents of fraud and money laundering, we need to have the most effective tools and techniques to detect suspicious activities. On the other hand, they should not create any friction or obstacles for legitimate clients," commented Sergey Petrov, co-founder and managing director at FINOM. "Resistant AI's solution perfectly complements FINOM's AML and Anti-Fraud program with its explainable AI, ensuring transparency to AML analysts as well as the regulator."

Resistant AI's technology enhances FINOM's existing in-house transaction monitoring system by adding additional context to existing alerts, the ability to detect previously unknown types of suspicious behavior, and deliver intelligent alert prioritization allowing analysts to focus on the highest risk cases first.

Resistant AI analyzes the hidden relationships between identities and transactions to draw a better decision boundary between legitimate and criminal activities. Advanced layering and muling techniques are identified, providing organizations increased visibility of novel criminal activity.

"We are delighted to help FINOM simplify and speed up the detection of suspicious activity," added Martin Rehak, founder and CEO, Resistant AI. "Criminals are always developing more subtle and discreet ways of moving money illegally; our tools use AI to spot both existing and new behavior without generating thousands of false positives which need to be manually processed."