Collctiv, a group payment app that allows friends, families, businesses, charities, and community groups to collect money together, has launched today in the USA.

Due to high demand, an eager waiting list of users in the US who have previously watched on from afar, will now be able to enjoy all the benefits of Collctiv.

The first of its kind in the US market, Collctiv serves groups with a focus on alleviating the pressure on group organisers to pool money in an easy and secure way.

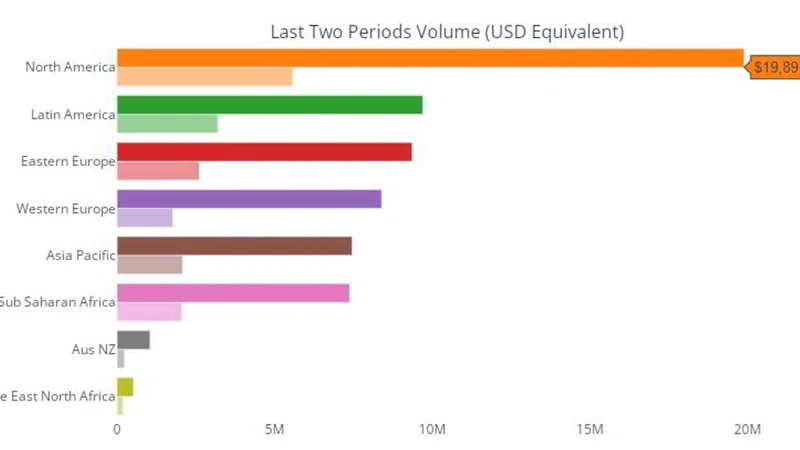

Hot on the heels of the company’s recent major milestone, reaching $20 million in proceeds transactions. Since its launch in the UK in 2019, demand for the solution has soared, resulting in the development and rollout of the US product being brought forward. By expanding to the US, Collctiv now has the perfect launch pad for international expansion.

Set for rapid growth, Collctiv’s US solution is predicted to replicate, if not exceed, the success of the current UK offering. In the UK, the group payments provider has seen an average monthly growth rate of 16% adding to their community of 420k users, including 15k companies. Although the product was not previously optimised for international use, payments through Collctiv have been received from 88 countries.

Co-founders Amy Whitell and Pete Casson have used their combined technical expertise to develop the app, which is designed to help organisers to collect money for the planning of events without ending up out of pocket. The solution also provides a lifeline to businesses and groups who need to collect money remotely for special occasions and celebrations.

Co-Founder and CEO, Amy Whitell, said: “The US market, with our shared language and cultural similarities, made this a priority market for us to expand into and we believe this provides the next phase of rapid growth for our company. There’s really nothing like Collctiv in the US, hence the huge demand for the solution. The digital payments space in the US is fragmented and dominated by P2P players who all cater for single peer-to-peer transactions.

“It’s a huge market that is underserved by current solutions on the market. Our solution helps to solve a real day-to-day problem and will make it easier for groups to collect and spend money. By utilising the power of online solutions, Collctiv is propelling offline interactions and bringing people together. We are really excited for the year ahead and hope to continue to solve the problems for organisers in the UK, the US and across the globe!”