MicroSoft, Smartstream, Oracle, Backbase, Network International, Zentity, Freshworks and Sybrin joined the foremost virtual edition of the 2nd Annual Finnovex

Southern Africa Summit to foster the development of strategies for steering the digital disruption era of the Banking and FSI Industry of the region with sturdy agility.

The Leading Summit on Financial Services Innovation and Excellence, which kicked off from the 27th – 28th July 2021 on the host’s virtual platform witnessed the attendance of 300+ CEOs, CDO’s, COO’s, CIOs, CISOs, CTOs, CRO’s Senior Vice Presidents, Vice Presidents, Directors, and Heads of departments from the Banking and FI industry.

The phenomenal and insightful event, which was organised by Exibex, took place virtually as a part of the Finnovex Global Series in its recently concluded 7th Edition.

This year’s edition was themed “Adapting Reinvention to a Rapidly Changed World” to reiterate the requirement for Banks to build up their digital identity by leveraging technologies to stay relevant in the current digitalisation era.

The Conference Chair, Cornel Dixon, Head of Africa at Backbase highlighted how timely the conversation was in relation to his regional experience and the current digital disruption era.

Backbase is currently a fast-growing fintech software provider that empowers financial institutions to accelerate their digital transformation and effectively compete in a digital-first world. It was founded in 2003 and privately funded, with headquarters in Amsterdam (HQ Global) and Atlanta (HQ Americas). More than 120 financials around the world have standardized on the Backbase omni-channel banking platform to streamline their digital sales and self-service operations across all digital touchpoints.

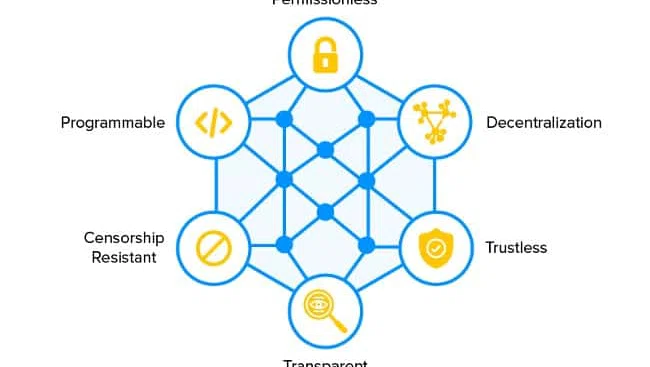

Still in alignment with the event theme, Servaas Venter, Sales Director- Financial Services at Microsoft highlighted how we have seen 10 years of digital transformation in the past 2 years. He also laid emphasis on how new intelligent and open technologies are transforming the industry via AI, Big Data, IOT, Blockchain amongst others.

Microsoft (Nasdaq “MSFT” Microsoft) enables digital transformation for the era of an intelligent cloud and an intelligent edge. Its mission is to empower every person and every organization on the planet to achieve more, which is grounded in both the world in which we live and the future we strive to create. Microsoft currently does business in 170 countries and consists of 144,000 passionate and dedicated employees.

In leveraging AI for the overall future of finance, Roland Brandli, the current Strategic Product Manager at SmartStream Technologies, talked about the how to use AI to check data to ensure the quality is correct. He also laid importance on how AI plays an important role in transforming the entire Banking and Financial Services Industry.

SmartStream Technologies is a recognised leader in financial transaction management solutions, which enables firms to improve operational control, reduce costs, build new revenue streams, mitigate risk and comply accurately with regulations. They also help their customers through their transformative digital strategies.

The Summit format consisted of speaker presentations and panel discussions, among the panel was the DEEP DIVE CXO PANEL, which was moderated by Karabo Moloko, Chief Executive Officer at Sybrin. They deliberated on how banking and financial institutions are evolving and their adaptation to Digital Disruption.

Sybrin is one of the most preferred strategic technology partners and has over 25 years’ experience in creating business value by applying technology to business problems and a primary focus is to ensure excellence in customer experience.

In addition to the brilliant contributions made by all the 25+ eminent speakers present, Hamish Houston, Regional President - Southern Africa at Network International L.L.C. echoed the impact of modern technology in accelerating digital payments within the African context. He also highlighted how every payment needs to be connected and completely seamless.

Milan Malenak, Head of Zentity Delivery - African Region at Zentity portrayed a true exemplary demonstration of the effectiveness of collaboration between Fintechs and Banking Institution in resolving digital banking challenges by making a duo-presentation with Ravi Moodley, Head of Product, Pricing & Channels for Africa at Nedbank to deliberate on these challenges and map out a revolution.

Zentity is currently one of the leaders in the world of integrated digital channels solutions. Their solutions and products thrive to motivate your customers to interact with you frequently and increase the flexibility of your digital channels. With branch offices spread across globally in - Czech Republic, Slovakia and the U.S.A., Zentity has delivered 110+ active complex digital solutions to more than 40 customers all over the world.

An active member of the Future Focus Panel discussing innovation and the overall financial services system was David Adams, Senior Vice President – Acceptance & Digital Solutions at Network International.

Network International has delivered innovative solutions that drive revenue and profitability for its customers for over 20 years. Their philosophy has witnessed a growth into the largest acquirer in the UAE and the leading enabler of digital commerce in the Middle East and Africa (MEA) region.

They provide a robust suite of payment products and services - that are on the cutting edge of technology development - to more than 80,000 merchant partners and 200 financial institutions across 50+ countries.

Aarti Mohan, Director Business Development ERP – ECEMEA Oracle highlighted how Oracle Enterprise Performance Management helping you outperform with agility would help make your organisation more agile.

Oracle is a cloud technology company that provides organizations around the world with computing infrastructure and software to help them innovate, unlock efficiencies and become more effective. We also created the world’s first – and only – autonomous database to help organize and secure our customers’ data.

Oracle Cloud Infrastructure offers higher performance, security, and cost savings. It is designed so businesses can move workloads easily from on-premises systems to the cloud, and between cloud and on-premises and other clouds. Oracle Cloud applications provide business leaders with modern applications that help them innovate, attain sustainable growth, and become more resilient.

In addition, the Finnovex Awards took place on the sidelines of the first-half of the event to recognise and appreciate the effort of over 10 individuals, institutions and service providers within the field of Banking and Financial Services Industry. The Awards seek to honour the pioneers and visionaries who have transformed the overall banking and financial services industry.

Finnovex Awards Winners include:

EXCELLENCE IN MOBILE BANKING - Absa Africa

EXCELLENCE IN DIGITAL BANKING - FNB South Africa

EXCELLENCE IN PAYMENTS - Network International

EXCELLENCE IN FINTECH - Zentity

EXCELLENCE IN CUSTOMER EXPERIENCE ENHANCEMENT - Standard Bank, South Africa

OUTSTANDING CONTRIBUTION TO FINTECH INITIATIVES - FirstRand Group

FINNOVATOR OF THE YEAR - Karabo Moloko

FINFLUENCER OF THE YEAR - Agrippa Mugwagwa

CEO OF THE YEAR - James Scott

COO OF THE YEAR - Munyaradzi Kavhu

CDO OF THE YEAR - Oswin Zulu

CIO OF THE YEAR - George Mensah

Outstanding Contribution in Digitalization of Banking - Rod Poole

Outstanding Contribution in Technology Development - Dr. Bongani Andy Mabaso

Outstanding Contribution in Data Analytics of Banking -Dr.Mark Nasila

Finnovex is excellently dedicated to examining the Future of Financial Services on how disruptive innovations are reshaping the way they are structured, made available and consumed.

The Finnovex Global series, which is organised by Exibex, examines the prospects of the overall Financial Services industry and how disruptive innovations are reshaping the way they are structured, provisioned and consumed. The Finnovex series of global Summits highlights thought leadership on cutting-edge issues with long-term implications to the industry and lays a concrete foundation for multi-stakeholder dialogues that explores the potential of these innovations to transform the overall financial ecosystem as well as the risks and opportunities that could emerge from shifts in the way financial services are designed, delivered and used in the future.

For more information on the Finnovex Summit editions coming up globally within the Middle

East and West African region in 2021, visit - https://finnovex.com/

If you would like to sponsor or be our event partner, please send an email to [email protected]