Agile businesses with a digital-first approach are winning

The costs of covering vet treatment for pets that have illness or accidents can quickly run into thousands, which is why taking out a pet insurance policy is a smart option. This is a topical issue in the UK, where there is a rising level of pet ownership that increased during lockdowns over the last 18 months as more people bought pets for companionship. Furthermore, pet prices have risen due to increased demand, so when an owner is paying thousands for a dog, the prospect of paying a small monthly premium to ensure its wellbeing makes sense.

Pet insurance is a growing market that is drawing in more insurers, who see the market opportunities. Additionally, some larger insurers have already left the market due to a lack of commercial success. Big insurers have struggled to adapt to this market because pet insurance is unique and many of the typical insurance practices do not work.

Early teething problems

The relationship between claims and policies also works differently to many other insurance categories. Claims tend to be more likely in the early part and towards the end of a pet’s life. Pets are prone to need more treatment from vets when they are younger, whether it is for routine procedures like being microchipped or neutered, or because young animals can be more daring and often eat and drink things they should not. They are also less cautious and experienced when they are younger and can be prone to getting into fights and other misadventures.

Therefore, insurers must deal with higher claims ratios in the early years and should expect to get around six claims for every ten insurance policies each year in the UK. This means insurers need to invest for the long term and not expect to make much profit in the early years. This can lead to backlogs in claims lasting several months.

Start-ups have competitive advantages

We are starting to see new entrants into the pet insurance market. Start-ups are using pet insurance as a base to build wider pet wellbeing businesses that can serve a range of needs for owners and their pets.

Insurtech companies and start-ups have fresh and agile business models that allow them to take a data first approach to the market, automating the pricing of policies and the claims process. As more information on pets, their susceptible conditions and long-term treatment costs is gathered, start-up insurers are implementing digital technology and using machine learning models. This helps these new players to interpret the big data on pets so they can make better decisions on pricing products.

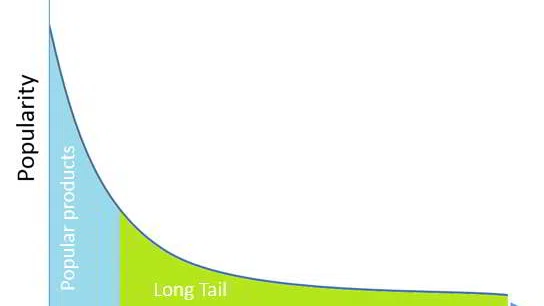

This allows them to offer cheaper policies to pet owners and in turn increase their competitive advantage over big insurers. Thus, there is a profitable virtuous circle for start-ups in the market at present. Only about 30 per cent of pets in the UK are insured right now. So, there is huge growth potential for start-ups before the window of opportunity closes and big insurers use their financial muscle to prosper in the market.