Financial services are going through a quiet but mighty revolution. Banking and payments are becoming more open source than ever before, providing access to tools and services previously locked from the public eye. On top of that, three separate metrics highlight the current shift in the market. 30% of customers are considering switching banks, 42% of customers have used a Buy Now, Pay Later service, and 2x ROAA for banks focused on BaaS offerings. These statistics are helping the introduction and representation of new banks and fintech ideas and solutions. Thanks to the explosion of Banking-as-a-Service, consumers are enjoying a wide range of new, exciting, and genuinely helpful financial products.

What is Banking-as-a-Service?

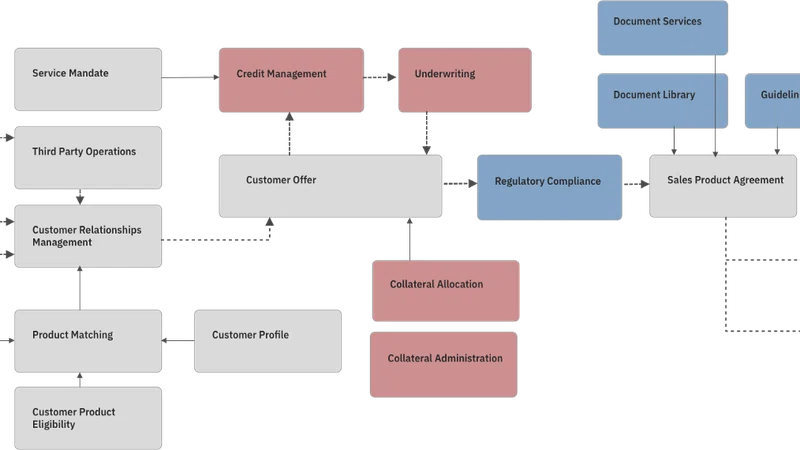

Banking-as-a-Service (BaaS) is an ecosystem of licensed financial institutions providing access to their embedded financial services to non-banking partners, generally through the use of APIs. To have a complete BaaS system, Licensed banks, BaaS providers, and Brands/Fintechs work together and connect in a symbiotic relationship to provide customers with the best possible products and services. An FDIC-insured bank lends its license to a BaaS provider and grants access to its financial products. The provider communicates with the bank’s infrastructure via APIs and delivers financial solutions for fintechs to use. Those, in turn, give access to banking functionality to their end customers, allowing fintechs to integrate BaaS functionality into their products, providing a safe yet ingenious approach to old fintech solutions.

Typically Banking as a Service providers offer complete embedded finance solutions including user interface design, products design and solutions, risk assessment and management tools, account management solutions, and more. The APIs these services use can be divided into four categories. Core banking services cover the fundamentals of the business like loans, deposits, and cross-border payments. Cards, digital wallets, and transfers APIs provide functionality for issuing physical/virtual cards, mobile wallets, and P2P transfers. Acquiring APIs take care of online and POS terminal acquiring, electronic payment systems, mobile/NFC payments, etc. Plug & Play APIs are ready-made modules that are compatible with any platform out of the box and include solutions for trading, oAuth, fraud monitoring, white-label banking, user interface, and more. These APIs provide a technical approach that creates a competitive advantage over more traditional financial institutions in a market where novel fintech startups emerge constantly.

An example of such a service could be seen in employee expense cards. This growing market relies on BaaS to deliver its products. Expense card startups ‘lease’ access to banking and payments services from regulated institutions such as banks and payment providers. They integrate these services with their own technology using simple, developer-friendly APIs. Then, they build their own tools, interfaces, and user experiences to help their clients solve the real-world problems associated with employee expense reporting. Some examples of such BaaS providers include Fidor Bank, The Bancorp, SolarisBank, and Treezor.

Until recently, this open model wasn’t possible. Fintech startups would previously have had to undertake the complex and time-consuming process of signing agreements with slow-moving institutions, then figuring out ways to integrate cumbersome proprietary banking technologies with their own product or service. To top off this expensive and challenging process, they would have to also face significant regulatory hurdles.

As its primary solution, BaaS has evolved to become a valuable and crucial new frontier in financial services. It removes many of the barriers that businesses faced in the past when trying to launch or integrate financial products, including complex regulation, slow-moving institutions, and old technologies. It means that financial services are more open than ever before.

Why is Banking-as-a-Service useful?

BaaS solves several fundamental problems that have been present in financial services today.

Traditionally, if you wanted to offer financial products and services, you would be subject to very specific regulatory obligations - perhaps even the need to secure a banking license. BaaS allows businesses to pick and choose the services they need from a wide range of dedicated service providers. By using APIs, businesses can easily access the parts of the banking they require allowing them to concentrate on building great products.

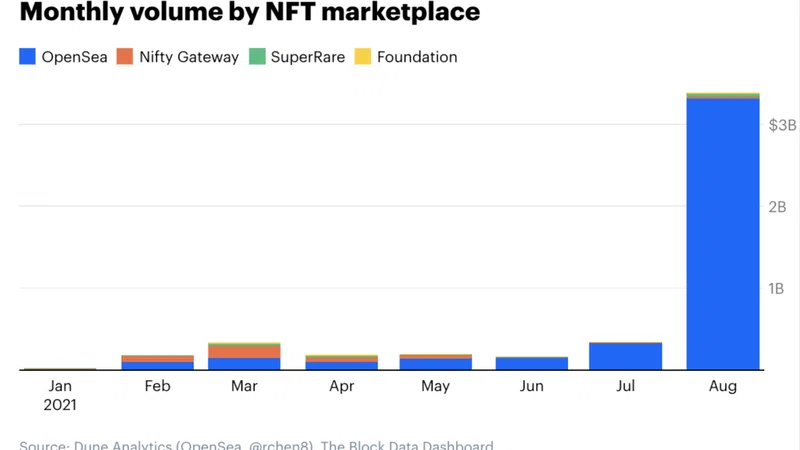

BaaS is also suitable for emerging industries. While lagging behind in terms of tech, central banks have become extremely risk-averse and are unwilling to invest in some fintech markets. This has meant that many businesses, especially those in new or untested markets, have struggled to access the banking services that they need. For example, crypto startups have been locked out of banking and payments services for some years. BaaS is able to open new doors for these exciting new markets being explored today.

With the rise of the online neo-banks, consumers are hungry for improved online banking services. Normally traditional banks have been very poor in delivering quality online products and services. BaaS gives consumers more choice and lets them avoid dealing with major banks and financial services providers while also providing cutting-edge infrastructure in order to deliver better and more affordable customer experiences.

Benefits of the Banking as a Service model

End customers:

Convenience, speed, and a wide selection of payment options are only some of the perks that BaaS platforms provide to the consumer experience. Never in history have buyers been equipped with more fintech tools for transaction and payments solutions. The end-user is able to receive more and more information and therefore are becoming empowered clients who demand integrated and direct experiences with the services or products they consume.

Brands/businesses:

Brands that have adopted embedded finance on their platforms are winning the loyalty of their customers and earning additional profits from these integrated financial products. They are also saving big on the infrastructure necessary to accommodate these banking services in-house. Outsourcing these solutions gives the business one less concern to worry about, letting them focus on providing the best core product or service to their customers. Some other benefits include reduced development time and costs, maintenance costs are transferred to the developing company, Introduction of new services for customers, strengthened position in the market, and increased customer satisfaction and retention.

Fintechs

Fintech startups get the unique opportunity to implement their financial solutions within tight timelines, on a reasonable budget, and without obtaining a banking license. The BaaS layer provides the necessary two-way data flow between banks and end customers.

BaaS providers

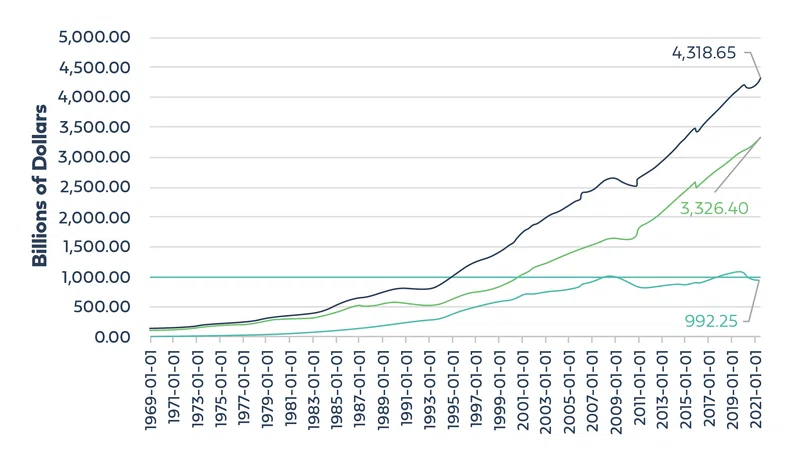

The global digital banking platform market is expected to reach $8.67 billion by 2027. This level of growth does not look like it plans to stop. Banking as a Service providers are set up for success due to profits from the transaction fees they collect and the innovative solutions they create.

Financial institutions

Banks stand to gain a lot from the adoption of BaaS. Thanks to commission fees, the added revenue stream provides an additional incentive to these institutions. This also helps the bank secure a better position in today’s competitive financial market. Lastly, the system's two-way flow of user data and information gives new insights into their customers’ buying and investing habits.

Banking as a Service vs. Open banking vs. Platform banking

Banking as a Service describes a model where customers interact with the service provider’s solution integrated into a merchant’s product. An example of such relationship can be seen when completing an eBay purchase by paying with your PayPal account.

Open banking is a scenario where a non-bank receives the customer’s data from a financial institution via an API, but no banking services are provided. An example of such service can be seen when using a personal budgeting app.

Banking as a platform is a digital ecosystem that allows third-party solutions to work directly with the bank’s infrastructure without a BaaS provider. This way, banks can give their customers a wider choice of options. Examples of these include chatbots or outside fintech services.

All three of these financial services are different, yet they each provide their own distinct value.

What does the future of BaaS look like?

A number of countries have already begun introducing open banking regulations, indicating that the financial services industry is moving toward an era where shared data and infrastructure will become consumers’ new expectations. Tech-savvy traditional banks that create their own BaaS platforms today will not only be ahead of the open banking competition today but will also unlock a new stream of revenue by monetizing their platforms.

The digital financial services landscape is changing rapidly, and Banking as a Service is paving the way for a new reality. Banks, fintechs, service providers, and brands can achieve synergy by building functional and efficient integrated solutions. In an interconnected environment, everyone will reap their respective benefits, provided they promptly adjust strategies.

As financial services become more fine-tuned to reflect the needs of consumers, BaaS providers will attract new customers. Better client profiling and added revenue streams will provide a well-deserved bonus for merchants. All merchants need to do is establish relationships with several relevant providers and manage them efficiently. The benefits of teaming up with providers and brands and reaching a much broader audience are even more conspicuous.