For as long as people have had insurance, people have tried to commit fraud – and in turn, working to ensure that anti-fraud measures are in place has always been a top priority of insurance businesses. Fast-forward to 2021, however, and new technologies are emerging to play a key role in the prevention and detection of risk and fraud.

While analytics has long been a facet of insurance, firms historically have focussed on the risk, legal and compliance functions, which traditionally relied on knowledge of rules, regulations, policy and law.

But this is changing; firms now have access to a huge volume of consumer data which, when paired with machine learning, is creating new insights, that enable everything from proactive decision making, risk mitigation and improve company performance. And in a world where sudden changes - whether a pandemic or local lockdown - can occur, it’s imperative that insurance firms can respond quickly and effectively: this is where data comes in.

Leveraging data in insurance

Already, data is being used to power connectivity with customers and generate insights into customer behaviour, driving risk pricing and customer engagement.

For instance, the analysis of business transactions such as payments to third-party claimants, vendors, policy underwriting and premium collections, and even employee expense reimbursements are all separate data points which could inform an insurance policy. Monitoring this data is crucial when it comes to detecting fraud.

But traditionally, this responsibility has been delegated to the claims, internal audit or finance departments, leading to compliance deliverables often being reactive and disciplinary. In turn, this caused “compliance fatigue” where too many manual rules, policies and procedures tend to be viewed by the employees, and sometimes management, as business inhibitors to driving growth. Thankfully this no longer needs to be the case.

Integrating data science and analytics into traditional compliance functions gives risk professionals a tremendous opportunity to drive better business transparency, which in turn drives better business performance.

Taking a metrics-driven approach and adopting the right IT architecture to analyse the data is helping risk and compliance professionals conduct better, more fact-based risk assessments, spotting high-risk areas, product lines, or business units. It also allows them to spot risks and anomalies faster than ever, reduce investigation costs by having data centrally organised and available data and enable compliance to present risks in a timelier, data-driven manner.

Learning about machine learning

So, while the benefits of data analytics for insurance firms are clear, how can they begin to deploy it and its insights across the business? This is where machine learning – a subset of artificial intelligence – comes in.

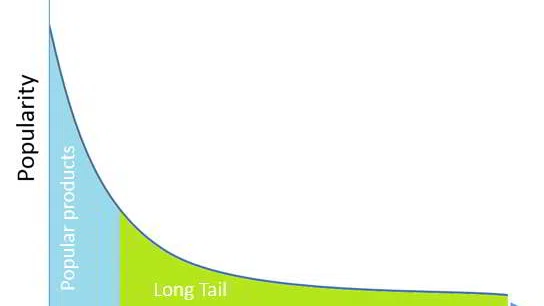

Machine learning uses algorithms to identify patterns and extract valuable details through statistical analysis and not actual knowledge. This can allow insurers to provide a faster, more personalised service, including suggesting offerings that might be needed, fast-tracking messages from insureds to the correct department and speeding claims.

Simply put, data can revolutionise the insights that insurance firms possess – and machine learning helps process larger volumes of it with much less time and effort.

Machine learning is useful for back-office purposes as well. Paper files can be quickly scanned, digitised and categorised to create a database to support more personalised insurance plans and better risk assessments.

It can also help dramatically transform how insurers interact with customers. Many firms are looking at their complete journey with the aim of providing a better unified customer experience; through pricing discounts, marketing the right products and upselling. It can be used with chatbots, self-service models, mobile apps for filing and policy changes, and more.

When paired with more powerful customer insights powered by data, machine learning is providing the insurance industry with better experiences for all parties. Working with a third-party vendor to ensure that firms have the architecture which can support a consolidated single source of data to power all of this, with real time streaming from all systems, is essential.

Ultimately, insurers need data for the insights that analytics can provide them to assess risk from individuals all the way up to macro trends. This requires the means to extract data and reinject the results into their core systems with optimal processes and architecture. Any lack of data (or poor data quality) can create gaps in analysis and cause integration and process flow issues, so it needs to be assessed as an end-to-end process and architecture. Insurers that do not have control of data will get left behind.