Over the past months, the NFT landscape evolved from a small ecosystem with a few hundred million in sales volume to a multi-chain ecosystem where individual projects like Axie Infinity have surpassed over $1 billion in sales volume. OpenSea facilitated $24 million in sales volume in all of 2020 and by August of 2021 surpassed $1 billion in volume. Unlike the DeFi ecosystem, non-fungible tokens are highly consumer-facing and attention-grabbing. As DeFi continues to build out the financial rails of the future, NFTs will cyclically advance into the cultural zeitgeist.

OpenSea is telling a canary in the coalmine for NFT growth. In June, OpenSea facilitated over 211,000 NFT sales across nearly 40,000 active traders.

In the month of August, NFT exchange OpenSea hit $3B in monthly volume as over 1.5 million NFTs changed hands. Its August volume alone exceeds that of every other month in its history, combined. OpenSea’s August volume is on par with $3B in gross sales Etsy put up in all of Q2: another sign of just how big the NFT market has grown relative to other online marketplaces in a very short timespan. 1

NFTs and Web 3.0

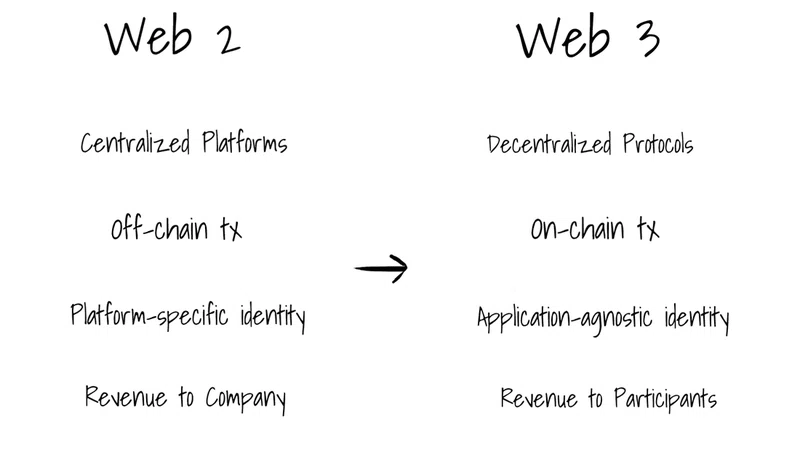

We spent the last 20 years building networks on the internet. Social media platforms like Instagram, Twitter, YouTube, and Discord are networks, which can be divided into billions of smaller networks, consisting of followers, friends, subscribers, backers, etc. These platforms gave many people an audience who didn’t previously have one. But due to fundamental structural misalignments between the networks and the companies that own them, we’ve seen increasing tension around these networks’ rules and economics. For example, social media companies that control large networks routinely kill off promising 3rd-party developers, fight cross-network interoperability, charge excessively high take rates, and adopt intrusive advertising models. This is not due to bad people or motives. It’s the logic of the model. If you don’t do these things, your competitors will, and you’ll be out of business.

We are now entering a new era of the internet — Web 3 — where we have the chance to upgrade these networks into economies, and in the process build systems where the incentives of the network owners, network participants, and third-party developers are fully aligned. Economies (as used here) are networks with various crypto assets freely flowing through them, from any node to any other node, directed by the decentralized participants and not by the centralized network owner.

At the end of the day, non-fungible tokens (NFTs) are simply a primitive of blockchains, like fungible, ERC-20 tokens. But the narrative of NFTs as a category has taken off to refer to a broader trend and thus, similar to DeFi, the term “NFTs” now encompasses its own ecosystem - Chris Dixon

The next evolution of content platforms is starting. Using crypto primitives – like NFTs, permissionless protocols, programmable royalties – content creators are set to control the next era of content – The Ownership Era

The Distribution Era: The key value in this era for consumers was aggregation while creators received wide distribution of their content(e.g. songs). However, as users realized that their content had value, beyond views and likes, individuals started to create their own brands.

The Subscription Era: Distribution is no longer worth the tradeoff. Personal websites are ubiquitous. Influencers host their own podcasts where advertising is the key form of revenue or have transitioned to Substack/Patreon where they directly monetize their connections to users.

The Ownership Era of Content: Platforms are partially owned by their content creators. The creators earn tokens for their work which provides ownership in the network. The platform-creator relationship becomes more synergistic as opposed to parasitic.

Content will remain king, but this time creators, not corporations, will control the reigns. As society shifts from valuing firms to individuals, creators who leverage these new web3 platforms will be poised for greater success - Mason Nystrom

NFTs - explain it like I am 10

NFT stands for non-fungible tokens. It’s easiest to think of NFTs as a file format. People use file formats – like jpeg, png, or gif – to transfer information or value on the internet. NFTs are a file format that transfers data and value on blockchain networks like Ethereum. Since NFTs exist on blockchains, these tokens (or files) contain properties similar to bitcoin, primarily digital ownership (a token in a person’s wallet) and transparency (all activity is recorded on a blockchain). We’ll get into some of the other noteworthy benefits that come with NFTs further below.2

The term non-fungible refers to the concept of fungibility. A good is said to be fungible if it is identical and interchangeable. For example, one dollar is worth one dollar. You would happily swap dollars with me since we all agree they have the same value. Comparatively, an item is said to be non-fungible if it is unique. Lots of items are non-fungible including diamonds, houses, and baseball cards. No two of these items are the same, diamonds have different colors and cuts while houses even in cookie-cutter neighborhoods have different locations which affect how light comes into the house. An NFT is simply a token (or piece of information) that is unique. A common example of an NFT might be a digital trading card or piece of digital art.

An amalgamation of a few factors was the perfect dry powder to ignite NFTs’ explosion into the mainstream psyche:

- Bitcoin’s insane bull run to 3x all-time highs from 2017

- The emergence of NBA Top Shot

- The convoluted monetization structure of digital content (inclusive of music & video)

- The growing digital collectibles market — especially during the covid pandemic

Characteristics of NFTs

While NFTs are simply a way to transfer information (data), they provide various benefits because they are created on blockchain networks.

While the value of an NFT can vary depending on how it’s used, generally speaking, NFTs provide the following characteristics:

- Unique – The hallmark trait of non-fungible tokens is that they are unique and this can be verified on a blockchain.

- Permanent – NFTs have permanent information and data that is stored within the token. This information can include a message, image, music, signature, or any other piece of data.

- Programmable – An NFT is just a piece of code on a blockchain. This means it can be programmed to have various qualities. One of the most useful qualities of NFTs to date is that royalties can be programmed (or built-in) to the tokens. This means an artist obtains a royalty on all secondary sales of their artwork.

- Permissionless – NFTs can be used in multiple ways if they exist on a permissionless blockchain like Ethereum (not all NFTs are on Ethereum). For example, Sorare – a sports trading card game – has third-party games (not built by the Sorare team) that use Sorare trading cards.

- Digital Ownership – whoever possesses an NFT in their wallet, owns and controls the NFT. Digital assets like domain names (Google.com) aren’t actually owned by Google, but instead by middlemen like GoDaddy or Verisign even though they control the rights to the asset.

These qualities empower various new use cases for NFTs.

Benefits of NFTs

The main benefits of NFTs are closely related to everything that distributed ledger technologies (DLT) have offered in recent years. Blockchain technically secures the authenticity of the NFTs, and it guarantees direct payments to content creators.

NFT Categories

Art

Digital art has taken the world by storm over the course of the past several months. Digital art combined with the digital property rights of NFTs (verifiable ownership) and perpetual royalties for artists makes NFTs a 10x improvement upon the current system. Most recently, the global auction house, Christie’s auctioned an NFT-based work of art created by Beeple, the top NFT artist by sales volume.

Digital Trading Cards

Sorare and NBA Top Shots are two of the most popular sports trading card collectibles. Sorare cards can be used in Sorare’s fantasy football (soccer) leagues while NBA Top Shots by Dapper Labs is developing a game that uses their NBA NFTs. Other digital trading card games include GodsUnchained which resemble strategy games like Magic the Gathering or Yu-gi-oh.

Provenance Tracking and Digital Certificates of Authenticity

Various items, especially collectibles and high-value items come with digital certificates. These certificates are often either stored as paper records or digital pdf copies. The benefits of digitizing these certificates and issuing them as NFTs means that any can verify the authenticity of the digital certificates and nobody can alter the information or misplace the document.

ConsenSys backed company, Treum has already piloted a program with the NBA that would authenticate memorabilia such as in-game worn jerseys that are sold during an NBA game via live auctions. While there’s always the possibility of a physical object being tampered with, digital NFTs can act as a better and more automated certification than existing practices.

Gaming items

Gaming assets are already digital in nature, so creating them as digital assets that individuals can own presents various benefits. There are multiple game studios building games that run on blockchain rails including Blockade and Horizon. Axie Infinity, a pokemon-style game has issued creatures called “axes” as NFTs that are used in Axie Infinity’s battling feature. Lastly, there are several platforms like Enjin which are building their own platforms that facilitate game development including the issuance, or minting of gaming assets.

Domain Names

Blockchains inherently make for great asset registries and one of the largest digitally native assets are domain names. Domain names are digital assets that map IP addresses to more human-readable names(e.g. 13.57.64.34 to Messari.io). Ethereum Name Service, Unstoppable Domains, and Handshake are three projects taking different approaches to enable domain names on blockchains.

Content

Music, blogs, tweets, memes, and other digital content can all be issued as NFTs. While that doesn’t make the content valuable it does present unique opportunities for digital ownership and on-chain royalties. Although the distribution of content may remain free for blogs or music, NFTs present unique monetization opportunities for crowdfunding content or selling a blog/song similar to how one might buy vinyl records or old edition books. Decentralized publishing platform, Mirror is enabling writers to crowdfund blogs and sell them as NFTs. Other experiments include the Kings of Leon selling albums as NFTs that provide additional value including lifetime concert tickets or exclusive experiential artwork for an album.

Tokenized luxury goods, e.g. wine

Another interesting area NFTs could have a real-world impact could be luxury goods. Luxury goods are constantly under attack from forgers trying to replicate products. An example of this is Fine wines. One interesting project to note is OpenSea. In February of 2020, OpenSea formed a collaboration with WiV Technology, a blockchain-based unique asset technology designed for wine producers and merchants, to support ERC-721 NFTs that represent physical wine bottles. This is the first time that a physical asset has been brought to the OpenSea platform. As NFT platforms evolve, NFTs will be used to help verify unique physical asset items.

Financial Products

Many types of financial products aren’t interchangeable. For example, your mortgage is unique to your house, length, interest rate, and more. Any simple financial contract can be issued as an NFT and stored on a blockchain. The real estate sector, in particular, suffers from serious barriers to entry, especially for younger people. The application of blockchain technology has the potential to radically change this industry for the better by broadening access, increasing transparency, and streamlining complex transaction processes. Nori has tokenized carbon removal credits as NFT where each Nori NFT acts as a certificate representing carbon removal.

Event Tickets

NFTs can also play a role in combating ticket fraud if every ticket was registered on the blockchain as an NFT. With blockchain-registered tickets, they are tied to their digital counterpart. This means that you can sell them through an online exchange by simply transferring the token. The exchange makes sure that you don’t charge extra, eliminating the risk of ticket scalping. A recent example of this was when the UEFA revealed it will use a blockchain-based ticketing system to distribute Euro 2020 passes to fans’ mobile phones. The digital tickets will only produce active QR codes via Bluetooth once fans are in close proximity to the venues, in a move designed to deter ticket scalping.

Tweets and Social Media Posts

NFTs present an opportunity to turn media into tokenized content. For instance, selling social media posts such as Tweets are the latest use case for NFTs. You have probably seen by now, but Twitter CEO Jack Dorsey is auctioning his first-ever published tweet as an NFT. Dorsey shared a tweet with a link to a digital platform called "Valuables," that facilitates buying and selling of tweets autographed by their creators. This new use case for NFTs opens up the possibilities for selling speech or iconic cultural moments on the web.

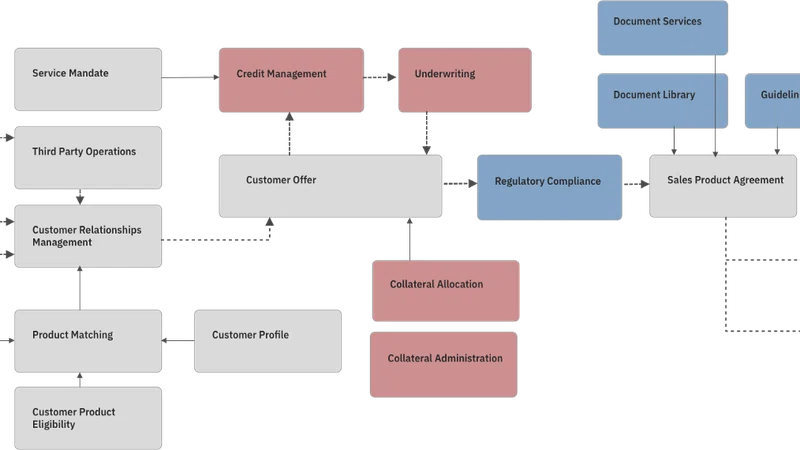

NFT Stack - Ecosystem

At the end of the day, non-fungible tokens (NFTs) are simply a primitive of blockchains, like fungible, ERC-20 tokens. But the narrative of NFTs as a category has taken off to refer to a broader trend and thus, similar to DeFi, the term “NFTs” now encompasses its own ecosystem.

However, non-fungible tokens will utilize many of the same financial primitives as DeFi and thus the stack ends up looking fairly similar but with a more consumer-centric lens.

Layer 1: Layer-1s

To date, the NFT landscape has been dominated by Ethereum, Flow, and to a lesser extent Wax. It’s likely that most NFT applications will need to transition from Ethereum mainnet onto a Layer-2 solution or sidechain while relying on Ethereum for the settlement layer. The exception to the rule may be for high-end digital art or blue-chip collectibles that require more robust censorship resistance.

Other base layers (Layer-1s) like Solana are actively building out their NFT infrastructure like Metaplex which enables individuals to set up their own NFT storefronts and issue NFT collections with customizable royalty splits.

Layer 2: Layer-2s & Sidechains

Most consumer-centric applications of non-fungible tokens – gaming, sports, virtual worlds, utility assets, etc – have experienced turbulence on Ethereum. After building CryptoKitties and CheeseWizards, Dapper Labs decided that Ethereum would never provide the robust scalability that the gaming studio required and opted to build Flow. Similarly, even projects like Sorare – that correctly determined where the scalability puck was going – built on sidechains like Loom that eventually shuttered – have struggled in their attempts to achieve the fully desired scale of their NFTs on Ethereum mainnet. Unwilling to rely on another third party, Axie Infinity took the path of building their own sidechain, Ronin, which to date has been very effective at reducing gas costs and increasing user adoption.

As an Ethereum hybrid Layer-2, Polygon’s biggest advantage to date has been its compatibility with Ethereum, which lowered the learning curve for both users and developers. Additionally, Polygon’s use of its token to incentivize bridging onto its network has been incredibly effective. Notably, Polygon is doubling down on NFTs with a new a $100 million fund for gaming and non-fungible token projects.

Layer 3: Storage

Blockchain layer-1s are often limited in the amount of on-chain storage capacity. Because not all NFTs – and the images or websites they reference – are stored on the layer-1 or layer-2 level, NFTs require another storage solution. Arweave offers permanent storage for NFTs while Filecion or Sia can also offer cheaper real-time storage.

Finally, individuals can use services like Filebase or Pinata which provide clean interfaces and enterprise desired services like S3 Compatible Object Storage and service-level agreements (SLAs) for companies that want to use IPFS or other storage layers but have formal and legal agreements in place.

Layer 4: Verticals / Applications

While non-fungible tokens are created and transferred at the Layer-1 or Layer-2 level, the application layer is one potential interface for the issuance of these tokens. Virtual worlds like Decentraland and Cryptovoxels have slowly grown over time as individuals enter the worlds for conferences, art galleries, casinos, and upcoming use cases.

Other applications like fantasy sports have experienced wild speculation, but continue to accrue new users. To date, crypto-based sports applications have been incredibly successful. Non-fungible token sports applications have generated over $800 million in secondary sales and likely over $1 billion when factoring in primary sales.

While issuance protocols that offer the creation of their own unique NFTs (i.e. SuperRare tokens or Zora’s zNFTs) may fit within the application layer, the primary benefit from marketplaces comes from their liquidity which is why I’ve placed those protocols in the financialization layer.

NFT issuance is a commoditizable layer that multiple layers of the stack can facilitate including:

- Layer-1 or Layer-2 blockchains and scaling solutions

- White label issuance protocols (e.g. Nameless is used for Veefriends)

- Marketplace protocols (e.g. Rarible)

- Individual applications (i.e. Sandbox, Uniswap, etc)

- Front end interfaces (e.g. Zapper)

Ultimately, platforms will have to rely on unique utility proposition that they can provide to their users. Virtual worlds can license content while Top Shot cards will be utilized in NBA Top Shot’s game Hardcourt.

Layer 5: Secondary Applications

Composability ensures that other developers can build atop existing applications and protocols.

Decentraland and other virtual worlds will undoubtedly have various applications within their ecosystems such as the online casino, Decentral Games. Additionally, Sorare has created a partnership with Ubisoft which is developing its own fantasy league – One Shot League – utilizing existing Sorare cards. The composability of this layer means that applications or protocols that facilitate third-party application development will have the opportunity to capture more value.

Layer 6: NFT Financialization

Similar to assets within DeFi, non-fungible tokens require similar primitives like lending, liquidity, and asset management. Additionally, while NFTs value proposition lies within their uniqueness, fungibility is important for increasing liquidity and the financialization of NFTs. To date, the projects focused on the financialization of NFTs are attempting to, unironically, make non-fungible tokens as fungible (and liquid) as possible.

Most protocols aiming to increase NFT liquidity have done so by either creating liquidity pools whereby individuals can deposit similar NFTs or fractionalize individual NFTs in order to encourage greater speculation.

NFT Fractionalization

- Fractional – Collectors create fractions of an NFT into fungible tokens which can be combined to redeem the token or the underlying NFT can be purchased for above it’s the reserve price.

- Niftex – NFT owners create shards (fractions) of an NFT into fungible tokens. The underlying NFT can be recovered by acquiring 100% of the shards or via a special buyout clause.

NFT Liquidity Pools

- NFTX – Collectors can deposit NFTs into an NFTX vault and mint a fungible token (vToken) that represents a claim on a random asset from within the vault or redeem a specific token from the same vault.

- NFT20 – A decentralized exchange where individuals can deposit NFTs into pools in exchange for fungible tokens (e.g. 100 $Punks tokens) that are redeemable for one NFT (e.g. CryptoPunk) in the pool.

- Unicly – Fractionalize an NFT collection into uTokens which can be traded. The specific collection (e.g. uPunks) is locked until

Yield Bearing NFT Assets

- Charged Particles – A protocol that allows users to deposit fungible or non-fungible tokens into an NFT. Charged particle NFTs can be programmed with yield-bearing aTokens.

- Uniswap V3 LP positions – By providing liquidity, LPs receive fees based on three tiers of fees for each pool - 0.05%, 0.30% and 1% – corresponding to various price ranges.

Marketplaces

NFT issuance platforms and marketplaces currently make up one of the largest categories of NFT protocols, and are one of the more obvious market opportunities given the business model.

In this regard, NFT issuance protocols and marketplaces will compete based on the following traits:

- Brand value

- Liquidity (depth and breadth of assets)

- Unique features (i.e. unique token standards, royalties, collectors fees, etc)

- Additional service offerings (e.g. partnerships)

While unique features such as royalties and collectors fees can one day be commoditized and built into token standards, they are currently non-standard and therefore act as a key value proposition for many NFT creators and companies.

Long term, marketplaces may aim to become closer to social networks in order to cement users to their platforms. This ironically would be a reverse of social networks like Facebook and Instagram which started as social networks and developed marketplaces afterward.

Layer 7: Aggregators

Aggregators can come in various forms. Some protocols aggregate supply while others focus on the demand (consumer) side. Within the NFT sector, there are really only two primary aggregators – OpenSea and Rarible. Both marketplaces aggregate supply by integrating various smart contracts and eventually blockchains. Since Rarible has only recently integrated the ability to buy and sell non-Rarible tokens on its platform, OpenSea has been the de-facto aggregator in the space.

While many view OpenSea simply as a marketplace, it also aggregates a significant amount of NFT data and metadata – data about the data – which is accessible via its API and can potentially be used for other purposes. Both OpenSea and Rarible continue to create full-purpose platforms for projects and individuals to issue non-fungible assets. As aggregators compete for growth, they’ll continue to expand their asset offerings across multiple blockchains.

So who captures the value in NFT ecosystem?

NFTs make the internet ownable - we are a point when we already established that scarce, permanent, ownable digital content has value.

Most of the NFT exchanges (i.e secondary issuance platform) charge a fee/commission today from the user/or the creator. However, the real value here lies in how the creator/artist is able to extract value compared to the platform and token issuer as part of the smart contract tokenomics.

NFTs flow through a number of layers from creation to collection. In the near future, all marketplaces will feature curation tokens as an incentive to release on a given platform. Tokens enable curators to signal towards which creators (and individual NFTs) are most valuable. Curators that attract the most sales earn the most rewards.

Curators share in a marketplace’s upside by earning tokens or receiving a percentage of sales when a purchase is made through a referral or based on a curator’s delegated stake. This is drastically different from today where fees are captured exclusively by the core team, rather than a global community of tokenholders.3

When this transition happens, the most active curator (measured by volume and usage) will receive the largest allocations of retroactive airdrops, drastically boosting their signal and curation abilities.

Moving forward, the largest rewards will be captured by those with specialized knowledge of undiscovered talent - essentially playing matchmaker between creator and collector to boost sales on their preferred marketplace(s).

- NFT value is directly correlated to the strength of its underlying community.: NFTs retain and increase their value by creating a diverse network of curators that share in that collection. This is the primary reason why CryptoPunks have performed so well.

- Curators decide which NFTs have value, and which do not: Curators signal to value and offer services like distribution and strategy to enhance that value.

Tl;dr: Key trends you need to watch out for

1) NFTs can unlock the Creator Economy by allowing creators to monetize directly; revolutionizing industries such as Music and gaming first

NFTs are revolutionary because ownership is immutable and irrefutable (for more background, read my first piece on NFTs here). NFTs also expand the pie by letting creators capture future upside. After a piece is sold, its value will continue to rise from the effort an artist puts into future pieces and into building his name. In the past, the artist could never capture that value.4

Spotify captures only ~33%, while artists receive less than 10%. This is in contrast to self-serve marketplaces like OpenSea, Zora, and Rarible, which let anyone mint and list an NFT. More recently, RAC and Zora teamed up on $RAC, essentially the singer’s own currency. Fans can’t buy $RAC, but only earn it by, well, being a fan. Fans earn $RAC by buying merch, supporting RAC on Patreon, and so on.

2) Social tokens can play a key role monetizing individuality for larger creators

Social tokens fall into two categories: personal tokens (fan clubs) and community tokens (social circles.) Both give holders exclusive access to a person or community. Personal tokens can be launched more quickly versus community tokens, which require coordinating a group towards a shared vision. However, community tokens may benefit from broader distribution, which has proven important in web2. As of Sept 2021, the total marketcap of all social tokens was $2B.

Social tokens build on various existing concepts. Fans financially support creators (Patreon), invest in their “stock” (Robinhood), and unlock special treatment for being a superfan (OnlyFans). Social tokens are different from NFTs in that they’re fungible. The brands of the future are people: if Nike, Starbucks, and Apple were the defining brands of the last 30 years, David Dobrik, MrBeast, and Addison Rae are the defining brands of the next 30. Social tokens will let everyday people support their favorite creator, both enabling communities to help create value and to participate in that value creation.

3) Its not about NFTs - the end goal is scarcity & social Networks on Web3

Arguing about whether DeFi is more important than NFTs or whether NFTs, DAOs, or Social Tokens will reign as the dominant social networks of web3 misses the point. Their interconnectedness is what makes web3 so powerful. NFTs create an impetus for people to quickly spin up DAOs, which then serve as NFT market makers. NFTs will act as keys to DAOs, governed according to social token ownership. The metaverse is comprised of the combination of these things, which, in turn, only increase the importance of being able to prove digital ownership.5

NFTs are memberships into digital communities.

— Ian ✺ (@ianDAOs) August 21, 2021

Social tokens are currencies that help digital communities economically coordinate.

DAOs are fully or partially automated entities that help digital communities get specific jobs done.

Everything is connected. But they’re not yet.

If the mantra of web2 was “come for the tool, stay for the network”, the mantra of web3 is probably closer to “come for the culture, stay for the returns.” And the returns are why most people are involved right now. NFTs combine elements of Instagram (influence and image) and LinkedIn (status and prestige.) Depending who you ask, owning a Punk is either like owning a Ferrari or having gone to Harvard.

But there is something more going on with NFTs. It’s not just about status anymore than they’re just a store of value. People held Punks long before they were a flex, and if you ask anyone trading NFTs, they’ll tell you that selling them is the worst part. Maybe that’s because when you sell your NFT, you also lose your tribe. An NFT bonds you with your fellow Apes and communicates to everyone that you belong to a certain group. The public ledger also ties you to a lineage of everyone who has ever owned that NFT. This not only adds a whole new dimension of value to digital art, it elevates you into a new social standing and even ensures your legacy in a way (you’re now an unforgettable part of history). I recently got 75 $FWB tokens to join the revered Friends with Benefits DAO, and can start relating to the sway a close-knit community.

4) DAOs are a crucial aggregation layer for Social Circles

Decentralized autonomous organizations are internet-native collectives that share resources, build products, and work together toward common goals. DAOs, literally and figuratively, are a Discord. DAOs also enable Wall Street Bets (partybids) to actually win against Wall Street sharks (whales) and turn web3 into a massive multiplayer online role-playing game. Amidst this explosion of NFTs and social tokens, DAOs will play the role of aggregator. Aggregators accrued most of the value in web2 and, in web3, DAOs will aggregate by collecting, curating, and moderating.

Social DAOs are the most explicit mechanism by which to combine both social and financial capital. They create digital social circles and can also empower a collective of individuals to flip power dynamics against wealthy individuals. In NFT bidding wars, they can empower a group of individuals to overtake an individual whale (sometimes causing them to switch sides and join the DAO). They also enable co-creation and collective participation in a way that isn’t really possible on web2.

The biggest opportunity web3 has relative to web2, is that web3 doesn’t have to be zero-sum. It’s multi-player and participants literally have a vested interest in each other and the quality of the communities they build. The value generated by web3 should at least accrue to those creating art, contributing content, and building lasting communities rather than siloed monopolies. Participants will finally have a voice and a vote.

5) Whether NFTs are a bubble or not, the underlying use cases can solve real pain points, starting with the creator economy

Big challenges today: Emerging creators lack upfront financing, top creators want to grow their audience, early fans want validation in being part of a creator's community and equity ownership > subscriptions.

NFTs can attempt to solve these through creator-issued collectibles (concept of equity ownership), exclusive, limited edition NFTs for early fans; NFTs to confirm participation to an online program, NFTs with "voting rights" to a selected group of super fans, build online communities weaving in NFT rewards etc. For the fans out there, scarcity and investment attractiveness, social validation, autonomy from centralized platform censorship can be powerful motivators.

6) Utility of NFTs will expand pretty quickly beyond trading and displaying

In 2021, some of the most interesting utility cases for NFTs will be around using as collateral in DeFi, lending/renting, creating social experiences around NFTs, using as an in-game item, membership (access, permissions, status) within a community or cross-communities etc.

NFTs being issued as tokenized carbon offsets and uses to enable national governments to issue and exchange ParisAgreement carbon credits to enable cross-border collaboration on emissions reductions. In-game asset nfts in "metaverses" such as Decentraland, cryptovoxels, AxieInfinity are land, clothing, creatures, weapons, etc, and even galleries showing off art NFTs. Once NFTs take off in the gaming industry, it will blow art NFTs away.

Some resources to keep up with the ever changing NFT landscape

Starter Guides

- NFTs and a Thousand True Fans

- WTF are NFTs?

- Collecting NFTs and Digital Art

- Beginners Guide to NFTs

- Non Fungible Tokens - NFTs are Transforming the Digital Art World

- Into the Metaverse

- NFT Skeptics Guide

- Analyzing Cryptoart Marketplaces

- The First $100M in NFTs

Data Platforms

NFT Newsletters

Podcasts / Youtube Channels

This article was first published here.

1 https://messari.io/article/the-nft-stack-exploring-the-nft-ecosystem

2 https://messari.io/article/explain-it-like-i-am-5-nfts

3 https://variant.mirror.xyz/T8kdtZRIgy_srXB5B06L8vBqFHYlEBcv6ae2zR6Y_eo

4 https://digitalnative.substack.com/p/the-digital-renaissance-how-nft

5 https://justine.mirror.xyz/dQtmHWtUcUsb_-rUtOgc8fzCn5z6lw1cLoMcswykV3I