Lithuania is becoming more attractive for fintech companies than the UK and other traditional countries. Let’s discuss the benefits of this new fintech hub for tech startups.

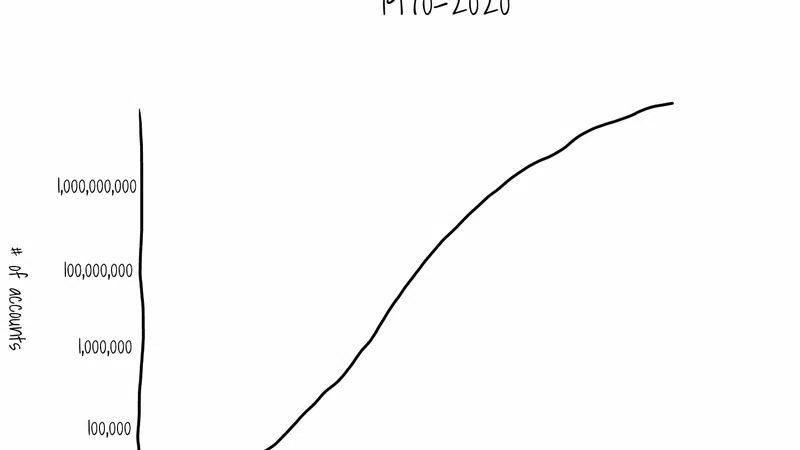

While Frankfurt, Paris, and Amsterdam competed to gain financial businesses from London, Vilnius played into the hands of global fintech companies. 265 fintech companies are currently operating in Lithuania as opposed to 55 in 2014. About 40% of them are headquartered in other countries.

Traditional financial centers have historically carried a burden, which they cannot get rid of. The problems faced by public infrastructure in the UK, Germany and the Netherlands are still acute. The issues of cooperation between the authorities and remote businesses are not worked out.

Meanwhile, the countries of the Baltic region, including Lithuania and Estonia, have a good approach to solving the problems of cooperation. They focus on creating public infrastructure to support technology companies. After all, the ability to register a company remotely does not mean anything without establishing communication with tax authorities and other government institutions. In terms of online access, Estonia is ahead of everyone, and Lithuania is successfully following in its footsteps. In the end, the comfort and speed of using government services without personal presence directly affects the efficiency of the company.

If you look for the disadvantages, you will, of course, find some of them. One example is the transportation problems. All you have to do to get to New York, London or Berlin is to buy a ticket for the earliest flight from anywhere in the world and often leave on the same day.

There are not many airports in the Baltic countries, therefore you will probably have to create a complex route to get to the financial centers.

However, in my opinion, this disadvantage is canceled out by the advantages. The reactive modernization of the public sector, which is grounded in technology business, is winning the hearts of many startups.

Lithuania is very advantageous for fintech companies. The country is on its way to granting licenses for electronic banks. A huge breakthrough is the ability to submit all applications remotely. Companies can easily tackle any issues with further development at the investor level. This is confirmed by the successful case of Revolut, which took advantage of the favorable conditions for granting licenses provided by regulators.

More than ⅔ of Lithuania's fintech companies, namely 147, are currently licensed as e-money institutions, payment institutions or specialized banks. This figure, which Lithuania is very proud of, is the highest in the EU, while France, ranked second, has 90 licenses.

The state fees imposed on fintech players by the Baltic countries are competitively viable. For example, initial capital requirements in popular Switzerland can vary depending on the type of cryptocurrency license or multiple licenses. Fintech license applicants must transfer 300,000 Swiss francs (about 289,000 euros) to the initial equity account.

In Lithuania, the fee for issuance of the electronic money institution license for unrestricted activities is EUR 1.463, while the fee for the license for restricted activities is EUR 1.235.

Licensing issues concern not only Lithuania, but all the Baltic countries. They are adept at reforming government institutions and then making proposals to the private sector.

This region seems very promising for neobanks. Lithuania, along with Estonia, is about to become a breakthrough fintech center. I see the potential for direct competition with the UK, which is even lagging behind in some areas. Yes, London has an established company registration process, yet the procedure for obtaining residency needs to be worked on.

The trusted partnership with fintech is beneficial to all countries, but not everyone fully understands it. The fintech sector is represented by technology companies, which are of great interest to investors now. They provide an inflow of capital that is converted into excellent teams working on their projects. Consequently, countries can replenish their coffers with tax payments. Who could ask for better? Meanwhile, other countries are left behind because they stick to traditional ways of doing things.

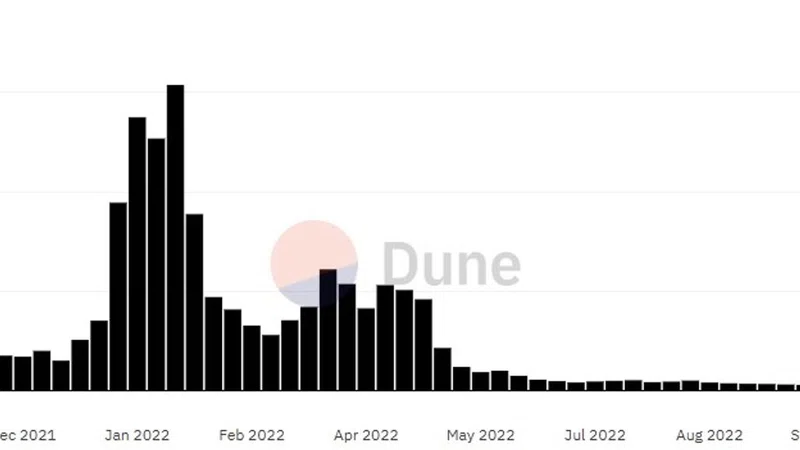

For example, fintech companies with Estonian residency brought in 32.5 million euros of tax revenue in 2021. In the first half of 2022 alone, Estonia collected a total of 24 million euros in tax revenues from e-residents. The total amount earned by Lithuania is not known yet, but I am sure it will not be small. Venture capitalists shattered records by investing 71 million euros in Lithuanian financial technology in 2021, which is nearly four times more than 18 million euros invested in 2020.

The country interacts with fintech companies very closely. I predict the technology boom in both Lithuania and Estonia in the next 5-7 years. Some of the success stories in the Estonian fintech sector include Arvato Bertlesmann, Bondora, e-Residency, Fitek, Fortumo, Friendly Finance, Funderbeam, Guardtime, IPF Digital, Monese, NASDAQ, Pocopay, Wise, etc. Lithuania does not have such an amazing track record yet, but fintech market players are already turning their attention to this country.

Of course, there are problems as well. Unethical companies often try to take advantage of loopholes in regulations and laws. According to the AML Basel Index, the country ranks 8th in the world for money laundering risks, with the United Kingdom ranking 12th and the United States ranking 30th. Last year, it was revealed that UAB Finolita Unio, a licensed Lithuanian payment company at the time, had been used to steal more than 100 million euros from Wirecard, the scandalous German payment system, before it collapsed in June 2020.

However, given that countries are just learning how to combat cybercrime, these are not bad indicators. Lithuania is actively acquiring knowledge using the experience of Estonia that has already built an anti-money laundering system. Now the country is further developing a fintech ecosystem, particularly the interaction between market players and central banks.

To sum up, I should note that I always consider Lithuania and Estonia together as they are neighbors and have similar mechanisms for dealing with fintech. These countries employ an innovative approach to interaction with the private sector, which should be considered by other countries. They managed to bring convenience to the next level: the process of company registration in Estonia takes only 20 minutes and is fully remote. Lithuania also follows this path. You will not find this minimal level of bureaucracy anywhere else in the world.

If you step into your time machine and go 20 years into the future, I think you'll see that other countries have adopted the Estonian and Lithuanian fintech approach.

These countries have simply gotten ahead of their time in terms of convenience. I can also call them quite safe in terms of compliance, money laundering and banking risks. They are constantly developing in this direction, reforming the system, while preventive risk management fuels confidence.