South East Asia has seen a Fintech boom and immense growth since 2016 but this market is still considered underpenetrated, and the reason is obvious: a limited availability of financial services creates major potential for development. For instance, according to the World Bank, only 49% of adults in Indonesia have official bank accounts; in Cambodia this figure is 22%, and in the Philippines and Vietnam – 34% and 31% respectively. Insurance and capital management penetration is also low. This state of affairs offers huge opportunities to Fintech companies: most of the population still does not have efficient tools to store, transfer and manage their assets or take out loans.

Government-level support of the industry, fairly flexible financial laws and Internet connectivity, and hence improved financial literacy actually pay off. Projects already launched on the market are based on advanced digital technologies and top customer experiences, and attract multi-million investments into Asia.

So what is different about Asian Fintech?

- India and China are the largest countries in terms of financial service consumers totaling 36% of the global population, with the total GDP reaching $16 trillion. An immense number of consumers and volumes of money invested in technologies are the key factors enabling the emergence of unique practices and better digital solutions worldwide.

- Asian services demonstrate the importance of optional functions not directly linked to finance management. Developing social connections, they use any opportunity to find out more about clients and offer them enhanced services, thus becoming able to compete successfully on the complicated Fintech market. Take, for instance, the Indian neobank PayTm which combines a bank and a store with more than 24 product categories providing comprehensive payment solutions to over 8 million sellers. Apart from PayTm there are a number of other bank product providers also having a substantial market share: DBS Mobile, Kotak, ICICI, AxisBank, YONO SBI. Or Vietnamese Timo which got the Asiamoney award “Best Digital Bank in Vietnam 2019” for offering, in addition to conventional banking, travel insurance against basic risks and the option to set up an investment account with the average income of 12% to 15% in 4 simple steps. Ranking second in popularity, neobank Momo landed 2.5 million customers thanks to its convenient wallet and extra payments enabled thereby, in addition to p2p transfers.

- Asian Fintech teaches to track the entire client path, including offline channels – for example, cash withdrawals without a card, various offline shopping methods, onboarding in the course of offline communications. To retain clients, an extensive motivational toolkit is used: bonus programs, online and offline cashbacks, extra products and services – everything to keep the user in the service ecosystem. ZA Bank (Hong Kong) is an interesting case in this context. The bank guarantees quick client service: if a loan issue takes over 30 minutes, ZA Bank provides a cash discount of 10 Hong Kong dollars for each minute of delay. In the Philippines Tonik, the country’s currently only neobank, partnered with MasterCard from the very beginning and joined its global payment network, thus compensating for the lack of additional services such as loans and investments whose launch is scheduled in 2021 – according to the bank’s founder Greg Krasnov.

- Wallets emerge from lifestyle services designed for other tasks. Consider for instance Facebook and WhatsApp – one of India’s most popular applications which had the potential to become the largest-scale service for transfers between individuals. Or the Chinese Alipay and WeChat which had enabled customers to pay for services (including offline via QR codes) way before banks and quickly send money to friends. Even though bank applications now have enhanced functions, China’s residents do not go to mobile banks and continue using super-apps, making them top Fintech solutions in the Celestial Empire. Singapore’s YoloLite, meanwhile, focuses on servicing children and their parents to promote financial literacy from a young age.

Asia’s Fintech sector boasts quite a few unique features like those mentioned above. The market is fairly flexible, certainly vibrant, customer-oriented and forward-looking.

Most promising countries for entering the market include Indonesia, Singapore, Vietnam, the Philippines, Thailand and Malaysia as their neobanking niche is just starting to develop. They belong to the “average” segment, and that is what is appealing about them. The higher-ranking Australia has accordingly stronger competition and there are more firmly established players there.

Here is a graph representing the Asian region’s business climate:

Do Fintech investments pay off?

Yes and no. Any Fintech project is backed by a growth strategy and clear planning but nobody can assure returns on investment. For example, the investments of $193 million delivered to set up ZA Bank have not paid off as at 2020 but there is a five-year plan for further development, one of the goals being to achieve profits. At the same time, India’s PayTm and China’s WeChat have been making annual profits for a long time now. Singaporean YoloLite is one of the ten local startups which raised $10 million in investments, with no return by now. Its compatriot, electronic wallet service MOMO raised $193 million in investments this January, indicating the project’s success and investor trust.

Which factors should companies consider when launching business in the region?

At a first glance, the picture is confusing: on the one hand, we see billions of users valuing comfy affordable digital services, and on the other hand there is low digital literacy and a high rate of poorer population with limited access to hi-tech services.

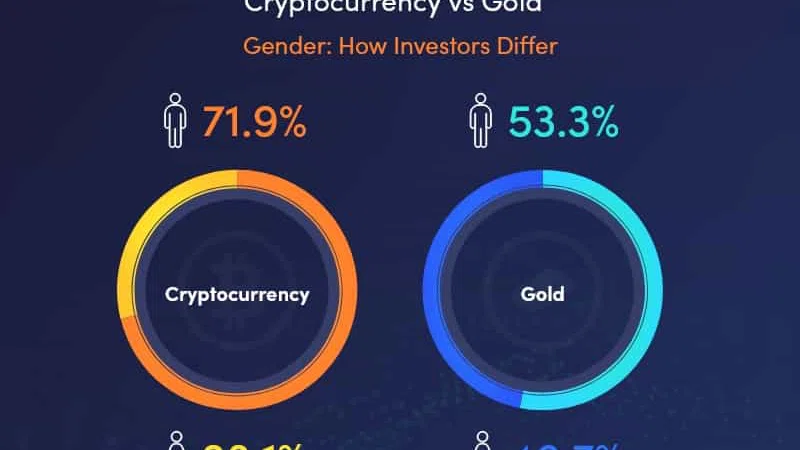

But if one looks at the popularity statistics of financial services, the picture becomes clearer: p2p transfers, online lending, social and other daily payments, e-commerce and investment solutions are in greatest demand; this especially concerns cryptocurrencies. For instance, 10% of Thailand’s Internet users hold some kind of crypto, making it the world’s top second country (after South Africa) in terms of digital currency ownership. So startup platforms in this sector should definitely target the Thai market.

As for my personal experience, here’s an example: we supported the establishment of a broker firm in China which had been successful in Europe and CIS countries. But having invested around $200,000 in the Chinese representative office, it actually failed – not having kept in mind the mentality and consumer demand: the Chinese did not need the things popular with the Europeans.

Summing up, here’s a checklist for entering the Asian Fintech market:

- Consider the overall business climate

- Obtain an understanding of the peculiarities involved in the legal entity registration (authorized capital, taxation, company incorporation time etc.)

- Secure the support of legal advisors: the Asian market is a complicated one, primarily due to the totally different mindset which creates an additional obstacle for foreign companies

- Recruit local experts and get current information to evaluate your product’s ability to compete

- Clearly understand your audience and their capabilities

- Think of the customer’s path long before they use application functions and always offer alternatives not available via other services