Overview:

Funding I track from Crunchbase data this week showed total that US$650ml of total capital was deployed across debt and equity by various types of investors into the Fintech & Crypto space. This represented about 40% of the total capital raised to date by the 26 firms included in this report. Of these firms, 5 reported new funding activities for the first time, with the largest being the series A reported to Crunchbase by Flowdesk, a firm operating in the crypto segment.

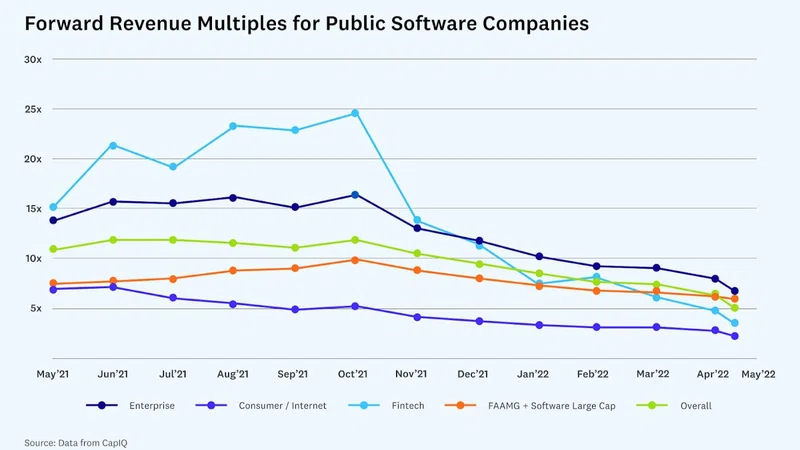

Funding activity overall was lower in the past week then the previous week primarily because the size of new debt raises to support lending platforms was much lower this week, even though Oppzo, raised US$255ml, Doorvest US$50ml, and Polysign US$25ml. There has been expectation that private debt will soon play a significantly larger role in Fintech financing activity as entrepreneurs adjust to much lower valuation multiples, so we will be watching to see if this trend unfolds, now that market momentum in some lending segments is moving from growth/scale up to consolidation/M&A.

Investors continue to show an appetite for a mixture of business models, and particularly in a sector like real estate, there is a strong belief that platforms can bring more benefits to all of the participants in the value chain. Investment interest in intermediary models also continues to find support, particularly when it comes to assisting advisors in broadening their service and investment solutions models. This was underscored by the funding received for CAIS, and Bondsmith from an asset class perspective, and Cadence, from a service provision approach.

Crypto Deals this week: Flowdesk (flowdesk.co), Ember Funds (emberfund.io), Pennyworks (pennyworks.com), Polysign (polysign.io), Kaiko (kaiko.com)

$167ml in total Financing, Deal Types, Earlier Stages, Mix of B2B and B2C business models, Targets include Financial Institutions, Web3.0 users, Institutional Investors and Consumers

Commentary: While the overall future from a valuation perspective for both the main investable assets in crypto and some of the major blockchain tokens used for payment processing remains highly volatile and uncertain, there continues to be a variety of different types of investment parties supporting infrastructure solutions for trading, clearing, and custody provision. This underscores expectations that in the midterm the primary investors in crypto assets may well follow the same path as other types of alternatives, i.e., dominated by institutional as opposed to retail clients, a development which would of course be quite ironic. Firms that provide vertically integrated platforms dominated the total capital outlay but early angel investors still helped B2C solutions for investment management, via Ember Funds, and Digital savings, via Pennyworks raise funding. I have opened an account with the former to check out their different strategies, as well as understand better the overall cost of moving funds between fiat, bitcoin, and strategies. My first effort at doing this cost e60 euros or a whopping 12% of my overall initial investment, so one can see how much retail investors are having to pay to play to those positioning themselves as “fund managers”.

B2B Deals this week: Long-Term Stock Exchange (ltse.com), oppzo (oppzo.com), we.vestr (wevestr.com), yufin (yufin.co), least (getleast.com), singletrack (singletrack.com)

$359ml in total financing, Deal Types, Very early stage, B2B transactions focused on SMEs although specialist deals also funded in capital markets and real estate participant segments

Commentary: The highlights of the week were the $255ml debt financing for Oppzo and the $100ml capital raise for the Long-Term Stock Exchange. The LTSE is an interesting innovation in the exchange space and is seeking to attract companies to list who are loss making today but hold high promise tomorrow. This is underscored by the fact that its first listing are for Asana, who had a -200ml net income line, and Twilio, who lost nearly 100ml. These were firms that were trading at roughly 6x their current levels about a year ago, and thus in theory represent businesses with a lot of long-term potential. Oppzo secured a mixture of debt and equity in its financing, which gives it the opportunity to establish a new niche in invoice factoring, as it relates to firms that secure govt contracts. These businesses often find themselves with cash flow challenges due to very slow invoice processing and Oppzo intends to step in and provide its own working capital lending solution. SME lending activities of this nature for new non-bank entities has been a huge focus by venture investors in the past 3 or 4 years, suggesting that the move by regulated banks out of providing these types of lending facilities may either be permanent, or represent a new trade sale channel back to banks, upon scaling, in the future.

B2B2C Deals this week — CAIS (caisgroup.com), Bondsmith (bondsmith.co.uk), cadence (cadencecares.ca), getmomo (getmomo.de), sapi (sapi.com)

$931k — 4 deals had amounts raised undisclosed, Deal Types, mostly early with more diversification in the underlying targets due to different segment focus (wealth, real estate and merchants/e-commerce platforms)

Commentary: B2B2C initiatives usually fall into two different buckets; the first covers providers that think of themselves as platforms for e-commerce participants who want to follow the “amazon” FS model, while the second addresses platforms in the wealth segment that want to enable advisors to broaden their investment management and planning capabilities. This week’s funding activity featured both with a UK firm Sapi raises an undisclosed amount from Passion in their Series A round for their embedded lending as a platform offering. The founders of Sapi have a lot of analytical and quantitative expertise in their CVs from investing in different types of credit solutions, so it might be their credit decision approach which helps them build their market position. Among those deals executed in the wealth/advisor segment, CAIS, a mature PE/HF investment fund marketplace followed Icapital Networks with raising an undisclosed additional amount, while my former employer FNZ announced a commitment to a new cash management firm, Bondsmith, that it helped incubate and create with former employee Michael Doyle. Bondsmith is coming into the market with a savings and treasury management solution design that will offer an alternative to the likes of Flagstone and Insignis. Bondsmith recently completed the acquisition of Wells Money Brokers to boost both its assets and the range of treasury services it can offer to institutional clients, some of which FNZ serves on the platform side today.

B2C Deals this week — Ophelos (ophelos.com), zilch (payzilch.com), April (getapril.com), Stake (stake.rent), Meritize (meritize.com), investengine (investengine.com), Doorvest (doorvest.com)

$149ml in total financing, B2C deals that covered the spectrum of consumer demographics as well as students, and higher income individuals. Deals mostly focused on the credit/lending segment, although we had the rare funding (via EC Crowdcube) of a robo-advisor too.

Commentary: We finish this weekly report with a look at the direct-to-consumer arena, where most of the deals are often related to funding regulated fintech firms. This segment is often dominated by firms that are based in the UK or the USA and this week was no different with the UK boasting 3 deals, Ophelos in debt collection, Zilch, in the BNPL space, and Investengine, in the Robo-advisory space. Zilch reported that it was able to achieve its series C funding without a significant mark down in its valuation, which means that firm was able to sell shares at around about a US$2bl valuation if the series B announcements in Nov 2021 were accurate. This week also saw a very large investment made in April, a new type of tax filing platform which works through a bank distribution channel. The platform seeks to leverage open banking principles to simplify the process of both completing the tax forms, as well as then submitting them for processing and potential refunds. While this is a space that already has a number of different software solutions, April does appear to be growing in the market through a different distribution strategy, so it will be interesting to watch how much traction it gets as it seeks to work with SME oriented community and regional banks who want to offer new business services to employers.