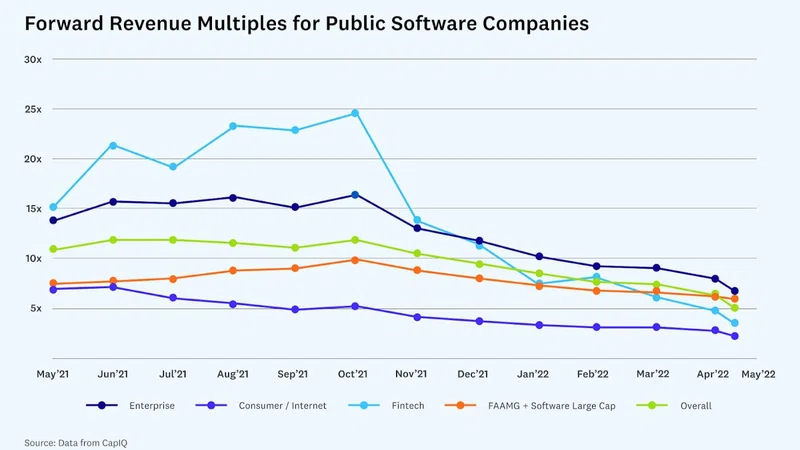

Overview: I am included, on request insurtech coverage for the first time in this week's coverage. In both value and volume terms this week provided a big jump from the opening week with 33 deals achieving venture related financing, raising a total of US1.9bl. While this may appear as a very strong financing amount, it should be pointed out that Klarna, Wefox, and Capchase contributed US1.6bl alone. The media coverage made falling late fintech valuations the theme of the week but actually, in my opinion, the return of strong early stage financing in wealthtech was certainly eye-catching as I will discuss, as was the continued strength of funding levels for A and B financing in Europe. Commentators have been expecting tougher fund raising conditions for early stage rounds, but we saw an impressive number of US5ml plus seed closings and a number of series A above US10ml. This was achieved by companies less than 5yrs old and thus still in the early stages of scale up.

Segment 1: Wealthtech

Iralogix, Eton Solutions, Lightyear, Stableton Financial, Hugosave, Here, Peggy, Ride Capital, Penny, Reach Finance, US$125ml

Commentary: I haven't seen a lot of investment, wealth and retirement oriented early stage initiatives funded for a while in the developed countries, but ths week, we had 10 with funding reaching US$125ml. The themes that continue to draw interest are 1) the democraticization of alternatives, with this week seeing new entrants in art (peggy), Pe (stableton), gold (hugosave), and here (vacation home partial ownership) all completing seed and series A. HNW and Affluent client initiatives that feature both software and managed services also got support, with IRA accounts being the feature of established player Iralogix, Eton Solutions closing a series A for their front office family office platform, and ride capital completing a seed financing for their SMA Gmbh structured platform solutions for those looking to create a tax efficient investment vehicle. Wealthtech remains one of the investment segments where locally oriented initiatives such as Penny's pension consolidation solution in the UK continue to attract funding, although Lightyear, the global low cost trading platform for selected high tech, growth and e-commerce stocks continues to impress with its fund raising success too.

Segment 2: Insuretech

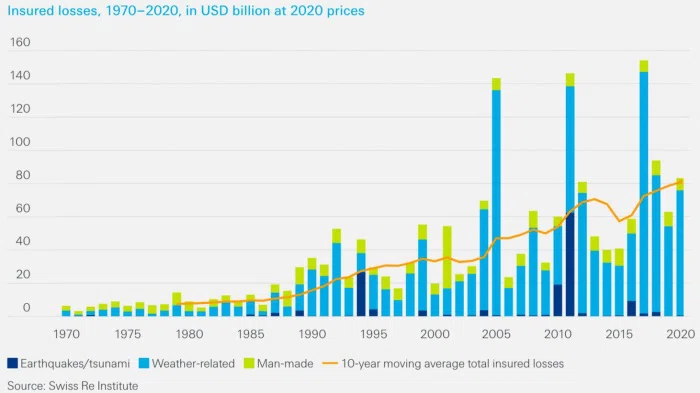

Webox, Calingo, Noldor, Snaprefund, US$412ml

Commentary: I don't normally cover Insuretech but am going to give it a try. The 4 deals I captured this week highlight the extend to which venture firms will support on the one hand entirely new digital insurance companies (wefox), while also looking for opportunities to support very specific sub-segments such as Claims Management (Snap refund), reinsurance (Nolder) and new digital brokers working with insurers (Calingo). In insurance, speed via digitization continues to attract broad funding providers, as do solutions that try to reduce the complexity in handling and asssessing re-insurance risk.

Segment 3: Crypto Related

Onramp Invest, Supermojo, Moneta App, US$13.1ml

Commentary: Crypto related ventures had a quiet week, highlighting that broader macro events are curtailing early stage financing efforts significantly. Onramp Invest did get a series A away for its e2e advisor crypto investment saas, so while market conditions may be challenging, specialist funds will continue to lend some support to solutions with an institutional oriented flavour. NFT financing has benefitted less from this so it was interested that Supermojo got its new financing model for NFT purchase successfully closed. BNPL seems to be finding its way everywhere.

Segment 4: B2B Fintech Lending

Capchase, Klarna, Built Technologies, Turnkey Lender, Oper, Credabill, US1.245bl

Commentary: Lending as well as Lending software received the greatest financing led by the Klarna deal and debt facility advanced to Capchase to continue its effort to turn saas revenue into asset financing. While there is debt financing appetite from non-traditional credit lendes supporting initiatives like Credabill, and Capchase, there is perhaps more interest from Corp VCs in digital platforms seeking to deliver e2e process automation through Ai/ML to specific lending areas. This was highlighted through the successful closing off Oper's Series A, which is targeting Mortgage processing, and the financing for Turnkey Lender which is offering an innovative platform for digital lending, esp. for those looking to build innovative credit decision models.

Segment 5: B2B Banking as a Service Platforms

Apiture, Quiltt, US$33ml

Commentary: I have commented before about BAAS API solutions and funding support for segment focused initiatives in the US market continued this week. Apiture which is targeted credit unions and smaller regional and local banks with its API first digital solution secured a US$20ml financing. Meanwhile Quiltt which is targeting to turn non-financials into FS enabled providers through its platform design closed a seed financing with an impressive line up of early stage investors.

Segment 6: B2B Fintech admin software

Pulley, Fuell, Yr Plans, US42ml

Commentary: Fintech firms often like to win over SME by bunding different types of services together. Often this is connected to a subset of the ERP landscape, ie. financing, or expense management, although it is also sometimes connected to employment benefits. In this week's financing we saw all three get support, with providers operating in different countries and focusing on different aspects of the ERM/EBC market. Pulley was certainly the standout in terms of financing with it successfully completed a 40ml series B financing for its equity management platform. I am not sure if the feature set of this its outstanding feature or not in a market that has 3 or 4 very large players, but I think the fact that this solution covers both aspects of fund raising, equity management, and equity incentives means it will have appeal to particular types of early stage, and scale up companies.

Segment 7: Payment and Remittance solutions

Kadmos, Dapi, Hero, Zasuu, US37ml

Commentary: Payments is the last segment we highlight this week. Payment innovation seems to continue to focus on three broad themes, 1) enabling the broader reach of faster payments (via bank transfers) using PSD2 rails (Hero) 2) looking at creating an integrated cross border payment/fx model (Kadmos and Zasuu) and 3) introducing bank encryption grade API connectivity (Dapi) to facilitate faster and more reliable fintech to bank services (esp. in emerging markets). These solutions underscore the fact that emerging markets are still challenging and costly enough to require new innovation in digital payment design and that SME can still benefit from new payment players (not banks) enabling them to manage their cash flow better.

Commentary: Payments is the last segment we highlight this week. Payment innovation seems to continue to focus on three broad themes, 1) enabling the broader reach of faster payments (via bank transfers) using PSD2 rails (Hero) 2) looking at creating an integrated cross border payment/fx model (Kadmos and Zasuu) and 3) introducing bank encryption grade API connectivity (Dapi) to facilitate faster and more reliable fintech to bank services (esp. in emerging markets). These solutions underscore the fact that emerging markets are still challenging and costly enough to require new innovation in digital payment design and that SME can still benefit from new payment players (not banks) enabling them to manage their cash flow better.