The Fed released its long-awaited whitepaper on central bank digital currencies (CBDCs) amidst the ongoing cryptocurrency regulation debate.

The paper’s purpose was to lay out the pros and cons of adopting a federal CBDC. However, the paper did not choose any sides and did not develop any formal conclusions.

This move comes as countries in Europe and China continue to press forward with their own digital currency plans and are at the forefront of the wide-ranging debate on how cryptocurrencies are transforming the financial sector and how they should be regulated.

China, for instance, has introduced digital yuan ahead of the Beijing Winter Olympics in February. Some experts say China and other early adopters of digital currencies could set standards for other countries, in part because different national digital currency systems would eventually need to coordinate seamlessly for cross-border payments. Even if a U.S CBDC isn’t released for many years, the research the Fed is doing right now is vital to figure out ways to integrate a future system with other countries around the world who have already started launching or developing a CBDC.

“The introduction of a CBDC would represent a highly significant innovation in American money.”

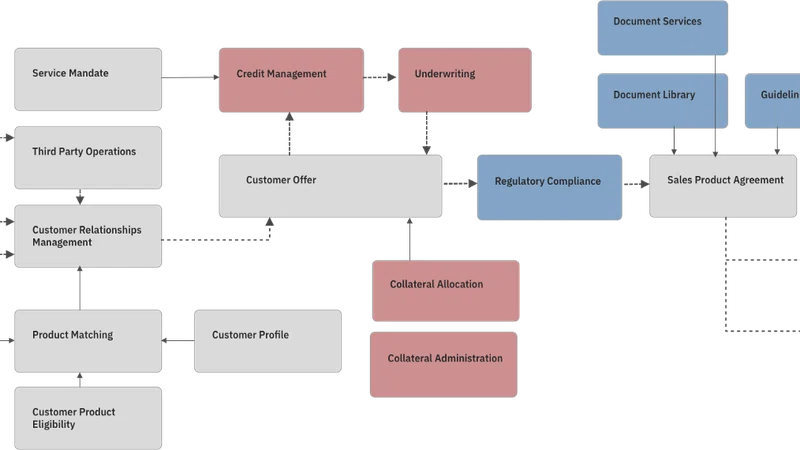

A CBDC itself would be considered a federal liability. Partnering with the private sector, the Fed would leverage banks’ existing privacy and identity-management frameworks to help better the U.S. financial system.

Among the benefits, the paper mentioned a digital currency that could help support faster and cheaper payments, expand consumer access to the financial system (especially low-income consumers), and help preserve the dollar's international status as a reserve currency, among other benefits.

Policymakers also think a federal CBDC would offer the general public access to digital money that is free from credit risk and liquidity risk. This option provides less risk compared to cryptocurrencies and stablecoins, although private sector stablecoins could exist alongside a federal CBDC in the near future.

However, not all was sunshine and rainbows; the Fed also laid out several risk scenarios. The main scenario includes how banks that rely on cash deposits could see a gradual decline if a CBDC is adopted en masse. That could, in turn, increase bank funding and storage costs, and raise credit costs for households and businesses all over the country.

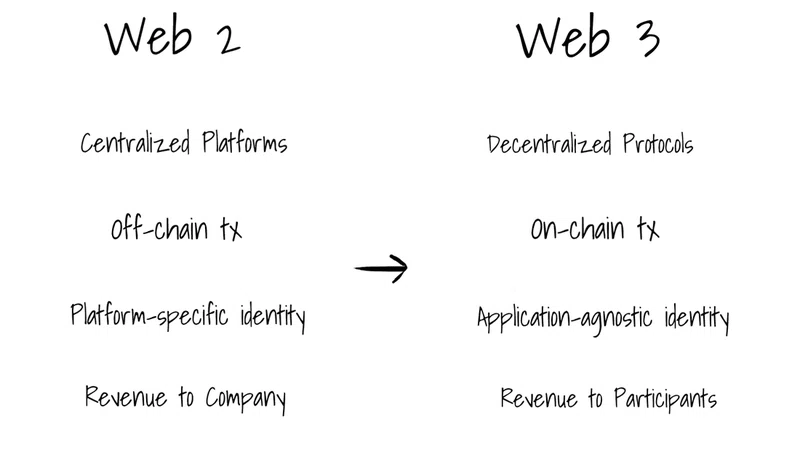

If adopted, the CBDC would need to protect consumer privacy, guard against criminal activity like cybersecurity attacks and money laundering, and be a widely accessible means and resource of payment that could transfer seamlessly between parties. The Fed has not committed on how such a currency could be issued, whether it would use the same blockchain that underpins other digital tokens like Bitcoin (BTC-USD) and Ether (ETH-USD).

Currently, there is a great deal of uncertainty when it comes to a federal CBDC. For example, the currency could have a ledger, or it could function like a physical dollar, which has no ledger. Also, it is unclear how CBDC bank accounts would work, given that the Fed doesn't house personal bank accounts. However, the one clear message is the importance of CBDCs for the future innovation of finance. While the Fed did remain neutral, the pros that they provided outweighed the cons, many of which can be fixed during future innovations. This leads many analysts to believe that a federal CBDC is within our future.