Lately, everyone is talking about NFTs, and seems like everyone is investing in NFTs. NFTs burst into the limelight when MetaKovan aka Vignesh Sundaresan bought an NFT for a digital art produced by Beeple (Mike Winkelmann) for $69.3 million in a Christie’s auction.

Let us see the big picture now.

Data Source: nonfungible.com collected on 9th September 2021, calculations by the author.

As we can see in the above charts that the dramatic growth in NFT is a very 2021 thing. Only in the last one year (as of 7th Sep 2021) NFTs recorded transactions of more than $3.6 billion US dollars with an average sales value of more than two thousand US dollars. 55% of that $3.6 billion i.e. $2.05 billion was recorded in the 30 days between 9th August and 7th September 2021.

Gartner’s 2021 Hype Cycle for Emerging Technologies termed NFTs as at the “Peak of Inflated Expectations”.

As it happens for all new technologies, the reality may be lost in the irrational exuberance. So, I looked into what NFTs really are.

I know many people hate it but it is going to be a little technical. Well, if we want to talk about something as technical as NFT, we need to get a little technical.

You probably already know that NFT stands for Non-Fungible Token. Fanfare of NFTs is tied to the phrase “Non-Fungible”. We will talk about what is fungible and non-fungible later, but first, let us talk about what NFTs fundamentally are. They are blockchain tokens primarily on the Ethereum blockchain.

What is a token? A token is a virtual value reserve on a blockchain network. What kind of value a token can represent depends on the token standard that is used to create the token. The popular token standards in Ethereum are ERC-20, ERC-721, and ERC-777. ERC stands for ‘Ethereum request for comment’.

Our focus is on ERC-20 and ERC-721 as they are the standards for fungible and non-fungible tokens.

So, what is non-fungibility?

When it comes to Ethereum tokens, non-fungible DOES NOT mean unique - but rather uniquely identifiable.

NFTs in theory are not comparable to snowflakes but to tracking dollar notes with their unique serial numbers. ERC-721 describes NFT as

“A Non-Fungible Token (NFT) is used to identify something or someone in a unique way.”

Please notice that NFTs can be used to identify something or someone in a unique way - what is identified is not necessarily unique.

How are NFTs different from fungible tokens?

So, let us compare the fungible token standard ERC-20 with the non-fungible token standard ERC-721.

ERC-721 tokens present two primary changes over ERC-20:

- Unique Token id

- Ability to attach asset metadata

Let us talk about them one by one.

Unique Token Id

Each ERC-721 token carries a globally unique ‘token id’ for a particular contract, unlike ERC-20 tokens.

“All NFTs have a uint256 variable called tokenId, so for any ERC-721 Contract, the pair contract address, uint256 tokenId must be globally unique.”

Let us understand the role of ‘token id’ by comparing the transfer function between ERC-20 and ERC-721.

ERC-20 (EIP 20)

- Transfer(address indexed _from, address indexed _to, uint256 _value)

ERC-721 (EIP 721)

- Transfer(address indexed _from, address indexed _to, uint256 indexed _tokenId)

Notice, the transfer function calls ‘_value’ in ERC-20 and ‘_tokenId’ in ERC-721.

‘_value’ is a variable representing the number of tokens to transfer and ‘_tokenId’ calls to a specific token. A real-world comparison may be like transferring $100 and transferring a dollar with a specific serial number printed on it.

Note: Again stressing the fact that even though the non-fungible tokens are uniquely identifiable, they do not have to be unique in value. Referring to a dollar note with the serial number printed on it does not automatically make it different from other dollar notes.

To drive the point of ‘token id’ home, let us compare two transactions - one for a fungible token and another for a non-fungible one.

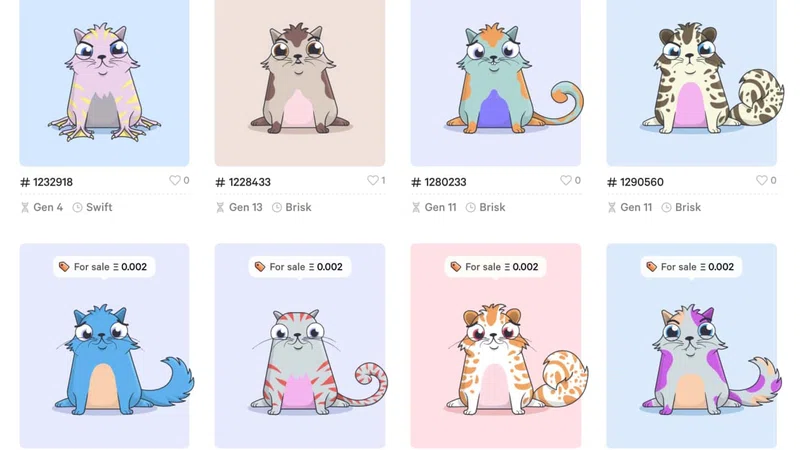

Here is a comparison of two transfers - one for USDT Stablecoin (a fungible token) and another for CryptoKitties Non-Fungible Token. Notice that the fungible token requires ‘_value’ parameter and the NFT requires ‘TokenID’ parameter.

- ‘_value’: The number of tokens to be transferred.

- ‘TokenID’: Specific token to be transferred.

Now, let us talk about asset metadata.

Asset Metadata

ERC-721 allows attaching asset metadata with the token as a JSON schema. Attaching metadata is optional for NFTs though.

Source: EIP - 721

The metadata gives the option to add some specifics to the token such as title, properties, and link to an image of the asset the NFT represents.

Please note that an NFT does not contain the asset itself but links to an asset. The blockchain does not store the digital asset for which NFT is created.

Are NFTs Unique?

So, do the properties and links make an NFT unique? In other words, can there be multiple NFT tokens with the same metadata?

To test that I created an NFT Contract in Ropsten test net - Sams NFT.

Then I minted a couple of tokens with the same metadata and nothing stopped me from doing that.

It was surprising. Don’t NFTs need to be unique?

Is it because I am minting NFTs on a testnet?

It seems that different NFTs can be minted using the same asset. Here is someone confused about that on an NFT Community on Facebook.

Another question is who guarantees that only a rightful owner of the digital asset can create an NFT. What if the assets used to create NFTs are themselves stolen. Many artists have reported seeing their art being stolen and sold in NFT form without their consent.

In some cases, viral social media posts are being converted to NFTs without the consent of the authors. Techcrunch reports “A Twitter bot known as @tokenizedtweets went on a minting spree earlier this year... Its policy of creating NFTs from viral tweets without the author’s consent or even notification caused an outcry from several actors, artists, and other creators.”

The uniqueness and scarcity of the NFTs come down to the owner of the asset and/or any centralized authority who can attest that only the rightful owners can create NFTs and the assets are indeed scarce.

The technology behind NFT ensures that the token is uniquely identifiable, the assets that NFTs represent do not have to be unique, or for that matter, the assets may not be absolutely secured. While the NFT token cannot be modified, the entity the NFT pointing to can be swapped or deleted. In one recent case, as part of an elaborate troll, an artist selling NFTs on OpenSea swapped out modern artwork for pictures of oriental rugs.

Ok, now consider a central authority guarantees that NFTs are being minted only for unique assets, by rightful creators, and the authority makes sure that the assets referred by the NFTs are not changed, what exactly do we legally own when we own an NFT?

Let us talk about that in the next part: https://www.fintechna.com/articles/evaluating-nfts-beyond-the-hype-part-2/