The insurance industry is one of the oldest industries in the world with an estimated global market size of $10.00Tn by 2030. Looking at the history of insurance, many would say that the UK is regarded to be the birthplace of modern insurance, dating back to the 18th and 19th century. During that era the UK had the highest level of insurance density in Europe. Both commercial and personal insurance emerged as the building blocks of economic and social progress.

Looking at the potential market size of the global insurance industry, it is evident that insurance is here to stay. In fact, the opportunities within the insurance industry will significantly increase in the years to come.

However, I am focusing on insurance during the last century and how innovation, technology and adoption have led to an insurance revolution across developing markets, and what the next 10, 20 or 50 years might look like. I am also digging into the ways technology could be a significant driver in improving insurance penetration into several emerging economies.

While the above timeline doesn’t do justice to all the events that occurred during the last century, it highlights some important occasions, incidents, companies, startups, regulations that reflect the growth and transformation of the insurance industry.

The birth of mainstream insurance in the U.S.

While the world’s first automobile insurance policy was issued in Dayton, Ohio in 1897, insurance companies widely known today started in the early 1920s, with State Farm being the first, and Allstate, Geico and Progressive to follow in the coming decade. These insurance companies introduced the concept of direct writers at the beginning of the 20th century and are among the largest auto and home insurers in the US.

All of these insurance incumbents were founded by individuals who once sought solutions for transferring risk by lowering costs through marketing directly to carefully targeted customers.

State Farm started as one man’s plan to offer low-cost automobile insurance to the farmers of Illinois: hence the name State Farm Mutual Automobile Insurance Company. Allstate emerged when Sears, Roebuck & Co. President and Board Chairman, General Robert E. Wood, sparked on the idea to selling auto insurance by mail. GEICO on the other hand started by selling insurance to government employees and military personnel (GEICO — Government Employees Insurance Company).

In 1944, the Supreme Court issued a ruling to federally regulate the insurance industry. The following year, Congress passed the McCarran-Ferguson Act, returning oversight to the state level. To this day, regulatory control remains primarily in the hands of the state. Each state has its own underwriting, rating, and policy regulation, creating a barrier for new insurance and insurance products to emerge.

In the same year, in 1945, acting president Truman made the first proposal for a unified national public health insurance, which however was unsuccessful. It took another 20 years to enact Medicare for Americans 65 and older.

As the population grew within the US and people moved throughout the country, other means of distribution were needed. This started the agency approach to selling insurance, by assigning agents to specific geographic areas, and setting up branch offices managed by general agents, later known as “managing general agents,” or MGAs. Agents’ compensation changed from fees for applications to percentage commissions on premiums collected. To understand more about the distinct role of insurance agents and the exploration of policyholder information ownership in the United States are handled, you can refer to this link.

Within the industry, insurance agents are classified as captive and independent. Independent agents sell more commercial lines insurance than personal lines (auto and home insurance), while the reverse is true for captive agents. One major difference between captive and independent agents is that the independent agent legally owns access to policy renewals, not the insurer.

GEICO, State Farm and Allstate are all insurance companies that will only sell their products through their agents (captive agents). However, most of those agents are independent contractors and are solely responsible for office expenses and hiring decisions within their agency. For example, start-up costs for a new GEICO agency range between $100,000 and $250,000, depending on the market.

In contrast, Progressive works with over 38,000 independent agents across the country as of 2021.

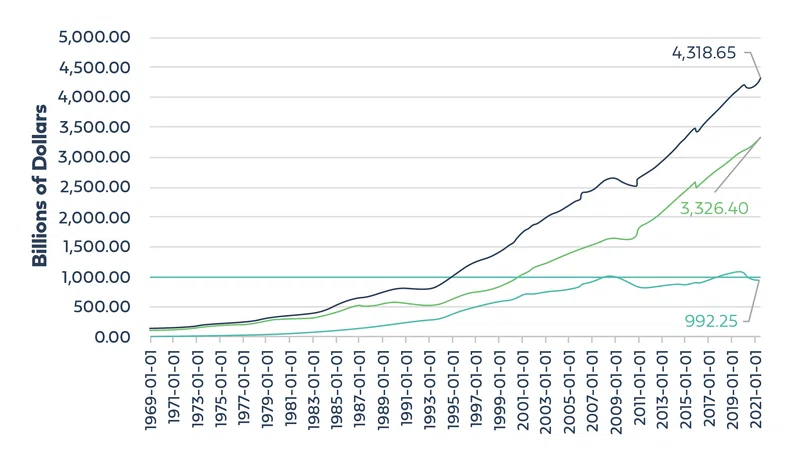

From 1920 through the 70s the incumbents all saw tremendous growth. In 1964, GEICO passed the 1 million policyholder mark and in 1965 it saw $150M in premium earnings. By 1956, Progressive had 40 employees and $2.6 million in written premium, while launching its Safe Driver Plan in Ohio, which offered low rates to drivers without accidents. The plan eventually evolved into what is now known as Snapshot. By 1969, Allstate had property liability written premium of $1.47 billion with 11.4 million active policies and more than 30,000 employees.

Emergence of digital systems & digital penetration within the insurance industry

Starting in the early 1980s software companies that built solutions for the insurance industry emerged. Some are still successful, such as Applied Systems, which specializes in insurance automation software for agency and brokerage management systems that automate the exchange of information and data throughout the insurance life cycle between agencies, brokerages, carriers and their clients.

With the introduction of the internet in the 1990s, insurers began offering policies online and insurance innovation started. Advances were made around distribution among early adapters surrounding price comparison websites and lead generation solutions — such as SelectQuote in the early 1980's. In fact, Progressive was the first auto insurance company to offer comparison rates and the option to buy by phone starting in 1993. Through the end of the 90’s, more companies emerged with a direct-to-consumer approach, and some innovation emerged around product warranty solutions as an add on (i.e., SquareTrade Inc in 1999).

In the 1990s various court decisions authorizing banks to sell insurance again, culminating in the 1999 Gramm-Leach-Bliley Act, which in part rules cross-selling and affiliate sales of product between banks, insurance companies and securities firms.

Other prominent companies such as Guidewire and Duck Creek started in the early 2000’s, building core solutions for property and casualty insurers. Those solutions have now become widely adopted within the industry.

In the early 2000’ entrepreneurs also started building digital MGA’s, digitizing the insurance distribution model. The MGA model specifically allows for customer experience and data control, while managing no significant balance sheet risk. A prominent startup emerged during that time — Weatherbill later named The Climate Corporation, founded by David Friedberg. While the original thesis of Weatherbill was to sell weather derivatives online to small businesses with weather risk, it eventually transitioned its focus fully on the agricultural side.

Starting in 2007 GEICO was able to add 1 million policies to its book every year, and grew from 8 millon policies in force in 2007 to 16 million policies in force by 2017.

While digital innovation steadily came into view, some traditional insurance companies struggled and emerging cross-selling distribution channels played out poorly. In 2005 for example, Citigroup decided to sell off its Travelers life insurance unit for $11.5B to MetLife, highlighting the tough time banks had cross-selling banking products and insurance. Following that in 2008, the government bailed out AIG through the Federal Reserve Bank acquiring a 79% stake for an $85 billion loan, which was subsequently increased and restructured. At that time AIG had become a major seller of credit default swaps in an attempt to boost its profit margin.

Around 2009, a pseudonymous person named Satoshi Nakamoto published a paper Bitcoin: A Peer-to-Peer Electronic Cash System, setting off the early innings for a newfound technology called blockchain.

Another important regulatory overhaul was signed into law in 2010 — The Dodd-Frank Wall Street Reform and Consumer Protection Act. While retaining state regulation of insurance, Title V in the act established the Federal Insurance Office (FIO), to coordinate the insurance sector nationally and regulate surplus lines insurance and reinsurance through state-based reforms.

The beginning of the Insurtech revolution

The early 2010’s set off a revolution, creating what is now known as Insurtech. Meaningful outcomes sparked the fire of others to build in and around the insurance industry, including Allstate acquiring Esurance in 2011 for $1B, and Guidewire’s $1.5B IPO in 2012. Another major contribution to the ecosytem was when Monsanto acquired David Friedberg’s The Climate Corporation for $1.1B in 2013. His work around selling insurance online and building a digital MGA sparked the interest of the venture community to explore that model even further. In fact, David started MetroMile in 2011, which “prides itself on being pioneers of the pay-per-mile car insurance model, providing a fair and affordable insurance for low-mileage drivers.”

Starting in 2015 the Insurtech wave started to take hold and venture capitalists and entrepreneurs, who once shied away from insurance related businesses, went all in. Companies categorized as challengers such as Lemonade, Next Insurance, Hippo, Root and many more materialized in the coming years, mostly choosing MGA as their business model only as an initial Go-To-Market strategy. This allowed them to enter the market quickly and test product-market fit, while mostly focusing on traditional flow-business distribution (home, auto, renter) and some new product innovation (commercial lines, on-demand or micro-duration coverage for smaller or episodic risks).

The strategy was simple yet needed; improving new UI/UX and be digital first, while providing a holistic customer experience. All of this was encouraged and enabled through smartphone penetration and mobile data surge.

These challenger startups that focused on traditional business lines expanded their business from B2C to B2B2C or even transitioned partly to be a carrier. This happened mostly as startups realized that customer acquisition is expensive and that the disintermediation of the traditional brokers and agents will likely not disappear in the near future.

Other business models that enabled insurance companies or aggregators increased in relevance after a slow start in the early 2000’s, with large funding rounds and either M&A or IPO exits. In 2017 for example, Allstate acquired Squaretrade for $1.4B, in 2018 Brown & Brown Insurance acquired Coverhound for an undisclosed amount and Lendingtree acquired QuoteWizard for $320M. Then in 2019, Prudential acquired Assurance IQ for $2.4B making it one of the biggest deals for an Insurtech at that time. Assurance IQ’s revenue at that time totaled more than $300M.

During this period incumbents became more and more involved in the startup ecosystem by either empowering startups through investing, data, insurance or reinsurance capacity, engaging in pilots and POC’s to learn and evolve or actually participating in or starting various incubators (e.g. Insurtech Gateway, InsurtechNY, PlugandPlay, Insurech HuB Munich, OnRamp).

Other hightech companies also dived into insurance by offering inhouse insurance solutions. In 2019 Tesla launched Tesla Insurance, a competitively priced insurance offering designed to provide Tesla owners with up to 30% lower rates. While incumbents have tried and still offer telematics based insurance solutions at lower rates, Tesla is the first automobile company to have an integrated offering for electric vehicles. Tesla’s pricing reflects the benefits of using Tesla’s active safety and advanced driver assistance features that come standard on all new Tesla vehicles without the need for an external device.

Bitcoin, Blockchain and cryptocurrency surged in 2018, while DEFI and insurance related crypto made their first market debut. B3i, the Blockchain Insurance Industry Initiative started in 2018 and worked on enabling and accelerating the insurance and reinsurance industry with distributed ledger technology. Shareholders include Achmea, Aegon, Africa Re, Ageas, Allianz, AXA, CPIC, Deutsche Ruck, Generali, Hannover Re, IRB Brasil Re, Liberty Mutual, Mapfre Re, Munich Re, SBI Group, SCOR, Swiss Re, Tokio Marine Holdings, VIG Re, Zurich.

The venture community started building in that space with companies such as Risk Harbor, Etherisc, Nayms, Ensuro and Unlashed Finance.

While insurance applications within the DEFI space today represent a minor subset, the opportunities are abundant in the future. That is also more evident as one the most prominent insurance markets and incumbents, Lloyds of London, introduced new cryptocurrency coverage in 2020.

While entrepreneurs dove into decentralized applications within insurance and financial services, the early builders in Insurtech started seeing results by taking their companies public. In 2020 and 2021 some prominent Insurtechs including Lemonade, Root, Hippo, MetroMile and Oscar made their public debut, joined by older Insurtech companies such as SelectQuote. However, the public markets have not been so welcoming to recent startups. In my opinion, the reaction is not surprising because startups realized that insurance is a capital intensive business, including regulatory capital, customer acquisition and operations. As a reference advertising spent, in 2002 GEICO’s spent $1.5B and Allstate about $900M, while in 2019 Progressive spent $1.66B and State Farm spent roughly $1.2B. While the startups were fast in onboarding customers, the results came with a price. Moreover, mediocre fundamental insurance metrics (loss ratios, expense ratios, combined ratio) that require significant maturity, were not substantial enough to navigate public markets at the time of IPO. In insurance, it is important to build an insurance book of business slowly and steadily, as insurance is a get rich slowly business.

It took GEICO 30 years to get to 1 million policies, and a little over 60 years to have 17 million policies in force.

It took Progressive 50 years and Allstate 62 years to go public.

While the race is not over yet, Insurtechs currently playing in the public markets need to rapidly adjust to sustain in the long run. Some of those public Insurtechs are already making a move and have diversified their book of business by adding other lines of business to navigate margins and profits e.g. Lemonade buying MetroMile to offer auto insurance, partnering with Bestow to sell life insurance or selling pet insurance as a bundled product. Other Insurtechs that have raised massive venture funding are sitting on the sidelines waiting for the right time of their public debut e.g. Kin, Next Insurance etc. Others are emerging in the speciality insurance lines and building the next generation of Insurtechs.

In Part II of The next wave of Insurtech, I will cover my predictions for what the next 10 years of insurance will look like. If you have an Insurtech prediction or want to be included, please reach out at [email protected] or on twitter @AmirKabir99

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.