Articles

How should fintech approach its online reputation management?

Given the fact that fintech is a modern innovation, a vast number of people still feel skeptical about its abilities and shy away from using its services

Sept. 13, 2022 • Konstantin Rabin

Fintech comprises two well-known concepts - Finance and Technology, and it is a highly reliable resource in order to enhance financial procedures. It serves both consumers and businesses and pr...

Physical vs digital cards – how the landscape is evolving

Data is emerging which shows digital payments are leading the way

Sept. 9, 2022 • Xavier Giandominici

With digital payments picking up steam around the world, it could be said that the future of the physical card is uncertain. The COVID-19 pandemic has accelerated the rate of digitalization, wi...

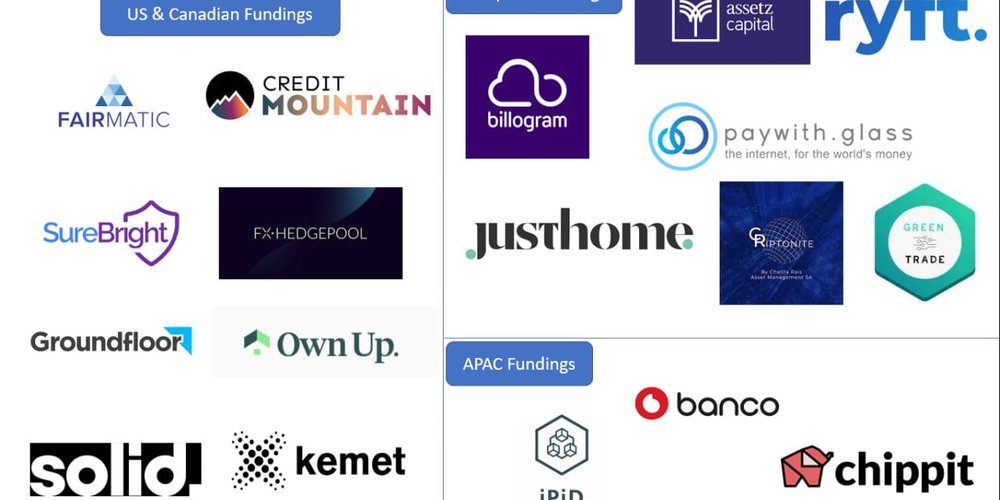

Weekly Early-Stage Fintech/Insurtech & Crypto Funding Report - 1st week Sept 2022

Featuring 17 transactions for companies based in Europe, APAC and North America

Sept. 5, 2022 • Roger Portnoy

Overview this week Based on our requirements, I am featuring 17 transactions this week for companies based in Europe, APAC and North America. My coverage features a number of pre-seed through...

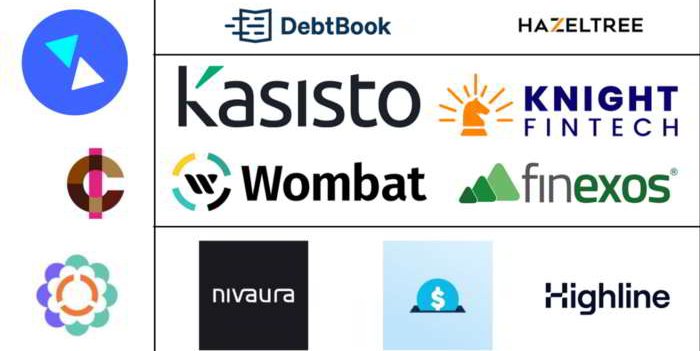

Fintech Early Stage Financing Aug 21st to Aug 28th: Developed Countries

11 early stage transactions of the week

Sept. 2, 2022 • Roger Portnoy

Overview: This week I am featuring 11 early stage transactions involving fund raises sponsored by Venture Capital firms, Growth Equity firms, Accelerators, Angel Investors and Corporate Sponsor...

KYC Remediation: Converting the backlog challenge into an opportunity

Increasing regulatory scrutiny often results in businesses having to re-validate their existing customers

Aug. 29, 2022 • Luke Hinchliffe

Increasing regulatory scrutiny often results in businesses having to re-validate their existing customers. The subsequent remediation process can be an onerous task, but if carried out correctl...

7 Tips for Founding or Managing a Tech Start-up During an Economic Turmoil

Creating a new venture during economic uncertainty is not for everybody. Yet, during every crisis lies a great opportunity.

Aug. 25, 2022 • Şebnem Elif Kocaoglu Ulbrich

Uncertainty might be a rule of thumb for start-up game; nonetheless, when economic turmoil and ongoing war threatens to shake the financial stability to its core, the entrepreneurial journey mi...

Why Visa is the biggest loser in the BNPL wars

Apple and Mastercard relationship is a potential game-changer

Aug. 21, 2022 • James Hickson

The launch of Apple’s Buy Now, Pay Later (BNPL) product has been viewed as an industry disruptor. It's no wonder that the likes of Klarna, Afterpay and Affirm, have seen their valuations...

Fintechs vs. banks and insurers: are they competitors or collaboration partners?

There was a view that all the things which a bank or insurer does could be done better and cheaper by a technology-powered fintech. And there is still some suspicion in the market today.

Aug. 11, 2022 • Richard Thornton

When fintech first became a ‘thing’ there were industry rumblings about upstart startups seeking to disrupt the market, with an eye to replacing banks and insurers. There was a view that all th...

AML Trends in 2022: Challenges and Prevention

Prevention requires constant evolution and effort from innovators, banks, government organizations, and businesses.

Aug. 10, 2022 • Miley Dowing

Money laundering has been an issue since the dawn of physical currency. As our financial institutions and digital technology have evolved, so has this pervasive financial crime. According to th...

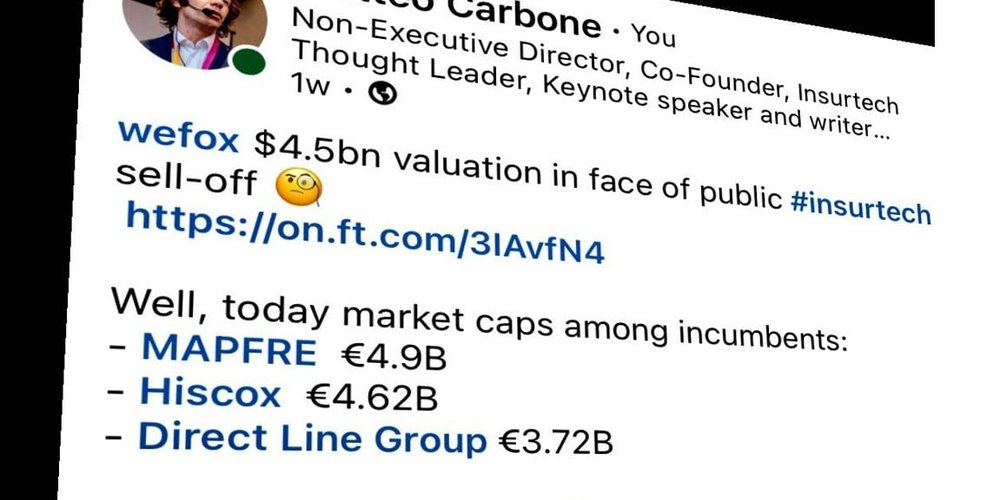

Will Insurtechs ever walk the talk?

Will the new generation of Insurtechs do differently?

Aug. 8, 2022 • Matteo Carbone

The news of the past month in the insurtech scene has been the WeFox round of financing at $4.5B ( $400 million series D round "which is compromised of equity and debt"). My first ...