Economic headwinds became particularly turbulent for the banking sector recently, with the “rescue” of Credit Suisse and Silicon Valley Bank adding fuel to the fear that another financial crisis is imminent.

While experts suggest that a repeat of the 2008 financial crisis is unlikely, the banking sector remains under increased scrutiny to prove and maintain stability.

With inflation and the cost-of-living crisis intensifying the economic pressure on businesses and consumers alike, the UK banking sector must reinforce consumer confidence and drive innovative approaches to enable better customer experience and reduce the overall cost to serve.

In light of this, banks are asking the practical questions - how can we reduce the overall cost-to-serve whilst delivering innovation and much better customer experience? Let's explore three ways in which the financial services industry can elevate itself through these turbulent times.

1) AI and ML to drive cost optimisation

To ensure financial security and stability amid rising operational costs, cost optimisation is key. Most banks have already taken advantage of offshoring and outsourcing to lower costs and are now looking at additional levers such as process simplification and automation, leveraging AI and machine learning to drive the next level of strategic cost optimisation. They must look at combining operations and technology to drive more strategic and sustainable cost savings in their businesses.

Investing in digitally enabled operations on the bank floor, enabled by new-generation technologies, will help streamline transaction processing, increase straight-through processing (STP) and consequently reduce the significant manual interventions that exist in many functions within a bank. While robotic process automation (RPA) has been previously used to streamline repetitive tasks, the focus must shift to Intelligent Process Automation, leveraging AI/ML capabilities and bringing in the ability to learn and adapt the automated capabilities.

This will lead to simplified business processes and operating models, and adaptive automation that can learn from new transactions they encounter. This in turn allows the technology to learn from any human intervention taken to correct anything within a transaction. It is possible to make up to 20-25% cost savings using process simplification and intelligent automation. Banking business processes such as Contact Centre Operations, loan origination and processing, fraud detection and customer onboarding can be significantly streamlined with AI/ML techniques, by improving the automation technology as it learns, to progressively reduce the amount of human intervention needed, thereby increasing efficiency and saving on costs.

2) Leveraging Fintech in products and propositions

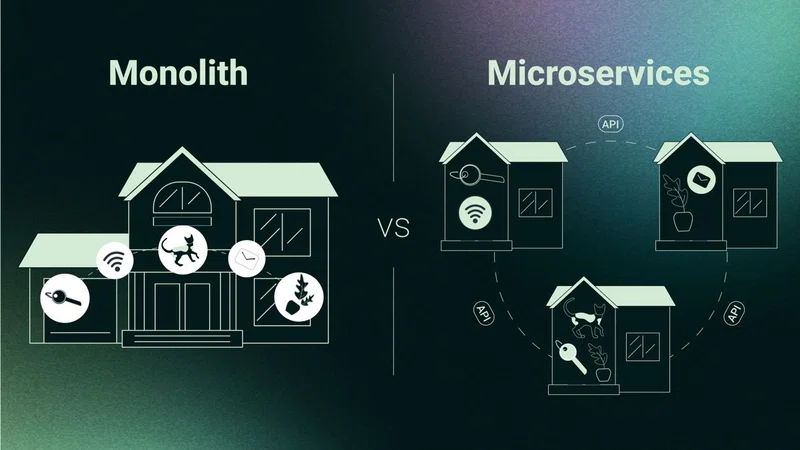

Innovation is vital in sailing out of the recession storm and providing banks with opportunities to utilise technology to connect with consumers in a more meaningful way, introducing new products and services that deliver value to their customers. However, with many traditional banks saddled with legacy technology infrastructure they are hampered in their ability to respond quickly to market demands.

Partnering with fintechs and incorporating their services in a seamless and holistic manner can help banks in meeting customer requirements and delivering superior customer experience. This partnership approach ranges from simple go-to-market collaborations to strategic investments into fintech companies, to outright acquisitions. Most of the leading banks have made such strategic investments in fintechs in the payments space, lending, KYC, and wealth management domains. Banks like Citi, JPMC, BNP Paribas, MUFJ are some of the more active players investing in fintechs to gain strategic and competitive advantage.

3) From transactors to expert advisors

Before the recent sharp escalation in interest rates, banks had been operating at low rates for an extended period of time. Interest rates have not been this high in over a decade, since the financial crisis of 2007/08, during which they reached a peak of 5.75%. Today, the UK interest rate stands at 4%.

This is a new situation as we now have a whole generation of customers that have become accustomed to low interest rates and high borrowing. With the sudden switch back to high rates, borrowers will need to get used to servicing their level of borrowing at these high rates or reduce their borrowings to a manageable level. Banks need to be prepared to support their customers through this transition. To deliver this support at scale, they need to be able to leverage the data and predictive capabilities of AI and ML.

Being proactive in reaching out to customers, understanding their financial situation and providing the appropriate advice on managing their finances will also help banks themselves, by informing better risk management and minimising bad debts. In these difficult times for customers battling the cost-of-living crisis, banks have a role to play in providing financial education to their customers and taking a relationship-based approach. Banks can do this by leveraging gamification tools, better using the customer data they hold within their books and leveraging AI/ML based models to help customers plan for their personal financial scenarios.

Economic uncertainty will undoubtedly affect banks. The industry needs to be resilient in becoming lean, shed costs, while remaining innovative and relevant to their customers.