Advances in fintech have ballooned in recent years, equipping consumers with neobanks, robo-advisers, and buy now pay later solutions that take the fuss out of day-to-day transactions. But these advances show no signs of slowing down, with 2022 being earmarked as the year of the fintech revolution.

That’s why at Stephenson Law we partnered with NatWest, Curve, Freetrade and many others, to provide an in-depth report on the Fintech Trends we can expect to see in 2022. From the rise of cryptocurrency to the growing pains of financial inclusion, the report provides a definitive bird’s eye view on the advances we can expect to see in this rapidly evolving industry.

Featuring insights from innovators of the fintech world, the report tackles a host of topics, from open data to super-apps, to the evolution of BNPL technologies. Clocking in at over 70 pages, the report is an exhaustive deep-dive, but what are some key highlights?

1) Open Data - a Game-Changer with More to Give

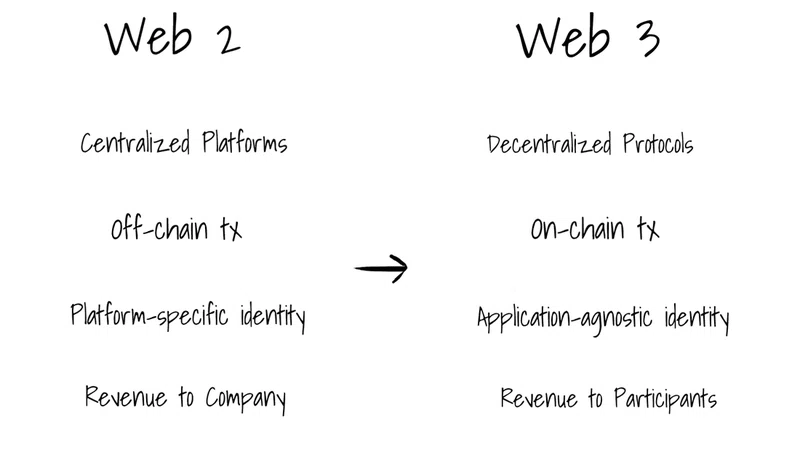

Open banking has been one of the biggest game-changers for both consumers and the financial industry, unleashing the power of data while fuelling innovation in payments and digital banking. However, various reports suggest that its potential has not yet been fully realised. McKinsey Global Institute proposes that to unlock the true value of open data, greater standardisation of the data sharing process and costs is needed, as well as wider data sharing (i.e. increasing how many entities can use the data). Crucially however, removing these two barriers will not make a significant impact if customer trust waivers.

User consent is the foundation of open banking, whilst transparency as to where their data goes and who it is shared with is a necessary pre-condition of customer trust. The fintech sector should avoid following in the footsteps of the ad-tech industry, where entire ecosystems were built with a disregard for individuals’ rights and badly worded consent requests. Here, data collected by tracking technologies sunk into the ad-tech ecosystems without a trace, leaving privacy notices so confusing and complex that even seasoned data protection lawyers struggled to understand them. The full potential of open banking (and more broadly, open finance) can only happen if financial ecosystems are built on transparency which gives users control over who can access their financial data and how it can be used. Even better, the goal should be to design in a way that is intuitive, easy to engage with and not obstructive to the overall user experience.

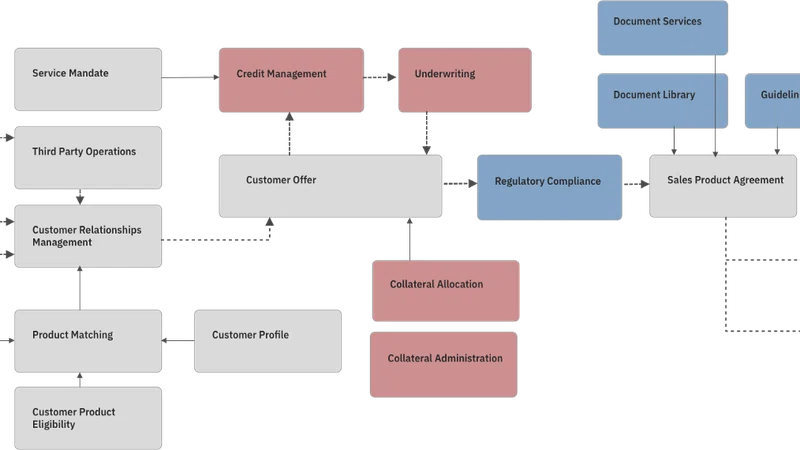

Innovative fintech solutions will need to strike the right balance between the need for regulatory compliance regarding consent, authentications, security and transparency on the one hand, and seamless user experience on the other, in particular when more complex ecosystems and relationships between various products start emerging.

2) Easier payments and a “Buy-Now-Pay-Later” Bonanza

Bank transfers and card schemes (such as Visa or Mastercard) are now no longer the only options. New players are constantly bringing innovative solutions to the market, with the ultimate aim of making payments an invisible part of the commercial journey. This includes Buy Now Pay Later (BNPL), which has stolen the limelight from credit cards, loans, overdrafts and traditional point-of-sale financing. 2021 has seen a rising tide of BNPL providers. Klarna in particular has cemented its dominant and international position, leading countless other providers to jump on the BNPL bandwagon.

One such provider is Monzo, which has launched its own BNPL product, designed with affordability in mind, which we believe is the future of BNPL. Virgin Money has announced a move to build a digital wallet with the BNPL feature built-in, alongside a reward club functionality. Many BNPL providers (like Klarna and Clearpay) are bringing BNPL to in-store purchases, by giving their users virtual BNPL cards. Other BNPL providers are in the process of enabling BNPL purchases via browser extensions. However, whilst 2022 is set to be abundant with consumer BNPL options, it will also be the year when this space is likely to come under the watchful eye of the FCA, which is planning to introduce a new set of regulations to help protect consumers. This will significantly impact the features consumer BNPL products can have going forward. We will also be seeing a growing offering of BNPL products in the B2B space, catering to SMEs.

3) Security, security, security

With COVID-19 came a surge in online sales, and an avalanche of online fraud cases. According to a report by UK Finance, in the first half of 2021, criminals stole a total of £753.9 million, an increase of 30% over the first half of 2020. Whilst in previous years the largest losses were due to unauthorised card payments, in the first half of 2021 criminals focused mainly on push payments, where the customer is tricked into authorising a payment to the criminal’s account.

These methods trick people into handing over account details, like their passwords and answers to security questions. The report states: “the level of fraud in the UK is such that it is now a national security threat” and outlines the need for a coordinated approach across industries, government, and regulators. Technologies used by fraudsters are becoming more sophisticated, so financial services’ in-house fraud prevention and cybersecurity teams will need to work closely together.

While it is vital for the banking and financial services industry to continue to invest in security systems and processes to protect customers, delivering customer education campaigns is just as important. National campaigns, such as Take Five or Action Fraud, are key to educating the public, but customer-facing financial services institutions have now started to recognise they need to educate their own users about online fraud. Some fraud cases are due to irresponsible online behaviour and poor cybersecurity habits (e.g. using 1234 as a password!), or simply not being aware of scamming tactics. So it is essential that individuals are made aware of the risks they face online, and customer-facing fintechs have an important role to play here; education is much more effective when delivered at the point of customer engagement, e.g. via an app, rather than a generalised campaign.

Is that all?

This barely scratches the surface on the advances we can expect to see in the Fintech space, and at over 70 pages, this report leaves no stone unturned. With insights from Natwest, Minima, Curve, TrueLayer, Savanti, Minna Technologies, Graphene I.S, Prift, Freetrade, Dext, Fnality International, Newcastle Strategic Solutions, Nook, PollenPay, and Financielle, the collaborative piece echoes much of the attitude within this growing sector: collaboration is key.

For more information on this report or to download it, head to the Stephenson Law website and dive into the future of fintech.